Dynamic Business: No ordinary disruption (NZ Herald)

Tim McCready

A handful of forces are shaping the future of what global business will look like

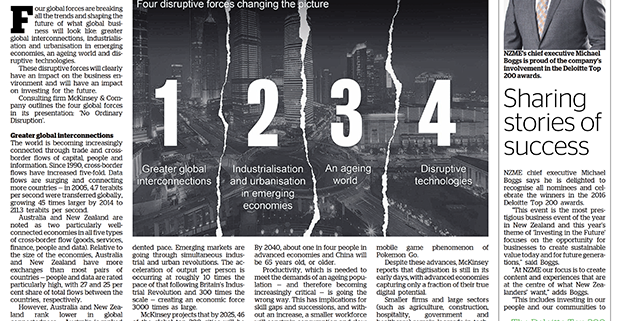

Four global forces are breaking all the trends and shaping the future of what global business will look like: greater global interconnections, industrialisation and urbanisation in emerging economies, an ageing world and disruptive technologies.

These disruptive forces will clearly have an impact on the business environment and will have an impact on investing for the future.

Consulting firm McKinsey & Company outlines the four global forces in its presentation: ‘No Ordinary Disruption’.

Greater global interconnections

The world is becoming increasingly connected through trade and cross-border flows of capital, people and information. Since 1990, cross-border flows have increased five-fold. Data flows are surging and connecting more countries — in 2005, 4.7 terabits per second were transferred globally, growing 45 times larger by 2014 to 211.3 terabits per second.

Australia and New Zealand are noted as two particularly well-connected economies in all five types of cross-border flow (goods, services, finance, people and data).

Relative to the size of the economies, Australia and New Zealand have more exchanges than most pairs of countries — people and data are rated particularly high, with 27 and 25 per cent share of total flows between the countries, respectively.

However, Australia and New Zealand rank lower in global connectedness — Australia is ranked 27th (down 10 places from last year) and New Zealand is ranked 48th (down five). This is in contrast to Singapore, the Netherlands and the United States who take out the top spots.

McKinsey & Company notes that the current slowdown masks digital transformation, but creates opportunities for smaller firms to participate. While Australia and New Zealand are strong together, it is important to acknowledge there is much more that can be done.

Industrialisation and urbanisation emerging

The rise of China, India and other emerging economies over the past 10 years has seen the global economic “centre of gravity” shift at an unprecedented pace. Emerging markets are going through simultaneous industrial and urban revolutions. The acceleration of output per person is occurring at roughly 10 times the pace of that following Britain’s Industrial Revolution and 300 times the scale — creating an economic force 3000 times as large.

McKinsey projects that by 2025, 46 of the global top 200 cities will be Chinese (in terms of 2025 GDP) and emerging regions of the world will be home to almost half of all Fortune Global 500 companies.

This massive scale and momentum means big shifts in economic power, but it is the mid-tier cities that are driving growth — not the megacities. Nearly three billion people will join the consuming class by 2025, bringing new consumers and competitors for businesses to consider.

An ageing world

The population of advanced economies is ageing rapidly. There are currently three countries where one-fifth of the population has passed the age of 65 — Germany, Italy and Japan. By 2020, 13 countries will fit this profile. By 2040, about one in four people in advanced economies and China will be 65 years old, or older.

Productivity, which is needed to meet the demands of an ageing population — and therefore becoming increasingly critical — is going the wrong way. This has implications for skill gaps and successions, and without an increase, a smaller workforce will constrain consumption and slow the overall rate of economic growth by up to 40 per cent over the next 50 years.

Disruptive technologies

Mobile internet and advanced robotics have seen massive increases in development pace. It took 115 years to advance from the first phone call to the launch of the first website — and then 16 years until the first iPhone was launched in 2007.

We have all seen the statistics demonstrating how quickly the adoption of new technologies is accelerating. The amount of time taken to reach 50 million users has decreased from 38 years for the radio, 13 years for television, three years for the internet, nine months for Twitter, to an incredible 19 days for the 2016 mobile game phenomenon of Pokemon Go.

Despite these advances, McKinsey reports that digitisation is still in its early days, with advanced economies capturing only a fraction of their true digital potential.

Smaller firms and large sectors (such as agriculture, construction, hospitality, government and healthcare) remain laggards in technology adoption, and are still a long way away from achieving potential benefits.

Both New Zealand and Australia are currently lagging behind the OECD average in terms of STEM qualifications.

Of all graduates, 18 per cent in Australia graduate from across science, technology, engineering and mathematics. New Zealand is slightly higher at 21 per cent (up five per cent from last year), yet talent across these subjects will be critical in shaping the future of our economies.

Leave a Reply

Want to join the discussion?Feel free to contribute!