http://bit.ly/2LBbKYC

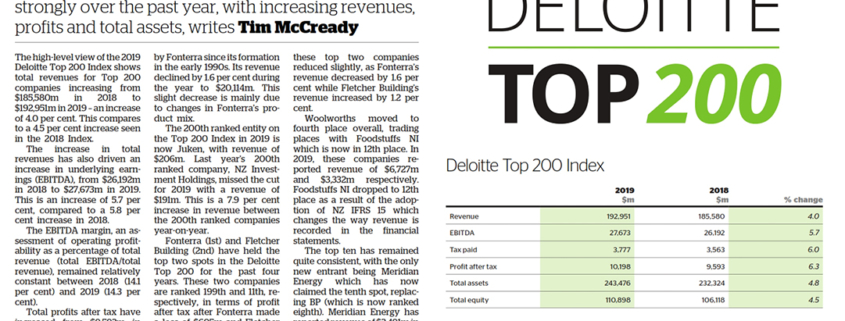

The high-level view of the 2019 Deloitte Top 200 Index shows total revenues for Top 200 companies increasing from $185,580m in 2018 to $192,951m in 2019 – an increase of 4.0 per cent. This compares to a 4.5 per cent increase seen in the 2018 Index.

The increase in total revenues has also driven an increase in underlying earnings (EBITDA), from $26,192m in 2018 to $27,673m in 2019. This is an increase of 5.7 per cent, compared to a 5.8 per cent increase in 2018.

The EBITDA margin, an assessment of operating profitability as a percentage of total revenue (total EBITDA/total revenue), remained relatively constant between 2018 (14.1 per cent) and 2019 (14.3 per cent).

Total profits after tax have increased from $9,593m in 2018 to $10,198m in 2019. This is a 6.3 per cent increase year-on-year compared to a 7.2 per cent increase in 2018.

Net profit margin (profit after tax/total revenue) stayed relatively constant between 2018 (5.2 per cent) and 2019 (5.3 per cent).

Total Assets have increased from $232,324m in 2018 to $243,476 in 2019, which is a 4.8 per cent increase and compares to a 6.2 per cent increase in 2018.

The number one spot in the Top 200 Index has been held by Fonterra since its formation in the early 1990s. Its revenue declined by 1.6 per cent during the year to $20,114m. This slight decrease is mainly due to changes in Fonterra’s product mix.

The 200th ranked entity on the Top 200 Index in 2019 is now Juken, with revenue of $206m. Last year’s 200th ranked company, NZ Investment Holdings, missed the cut for 2019 with a revenue of $191m. This is a 7.9 per cent increase in revenue between the 200th ranked companies year-on-year.

Fonterra (1st) and Fletcher Building (2nd) have held the top two spots in the Deloitte Top 200 for the past four years. These two companies are ranked 199th and 11th, respectively, in terms of profit after tax after Fonterra made a loss of $605m and Fletcher Building has made a profit of $259m.

Fonterra’s losses have largely been a result of asset write-downs of $826m, mainly on its offshore businesses. The write-downs include a $203m impairment of its China Farms investment and $237m on its New Zealand foods service business.

Fletcher Building returned to a profit due to the successful execution of the first year of its five-year strategy aimed to refocus and grow the business.

The revenue gap between these top two companies reduced slightly, as Fonterra’s revenue decreased by 1.6 per cent while Fletcher Building’s revenue increased by 1.2 per cent.

Woolworths moved to fourth place overall, trading places with Foodstuffs NI which is now in 12th place. In 2019, these companies reported revenue of $6,727m and $3,332m respectively. Foodstuffs NI dropped to 12th place as a result of the adoption of NZ IFRS 15 which changes the way revenue is recorded in the financial statements.

The top ten has remained quite consistent, with the only new entrant being Meridian Energy which has now claimed the tenth spot, replacing BP (which is now ranked eighth). Meridian Energy has reported revenue of $3,491m in the current year while BP has reported revenue of $3,699m. The rise in Meridian energy’s revenue is primarily from strong hydro conditions and higher wholesale market prices.

The overall increase in revenue this year has been reflected in the Government’s tax take from the companies that comprise the Top 200. Tax paid increased 6.0 per cent on last year’s figure, from $3,563m to $3,777m – contributing to the coalition government’s bumper surplus.

Leave a Reply

Want to join the discussion?Feel free to contribute!