http://bit.ly/TimMcCreadyDonaldTrumpMood

Tim McCready

The “Trump factor” is one of the major issues impacting chief executives’ confidence in the global economy.

In last year’s Mood of the Boardroom survey – held just over a month before the US presidential elections – CEOs rated the election outcome as their third greatest international concern impacting on business confidence.

A year on, they see Donald Trump’s presidency and its resultant political instability as taking the edge off a generally positive outlook. CEOs rated the “Trump factor” their second highest international concern at 6.47/10 with 10 saying they were “extremely concerned” about its effect on political instability.

“The Trump regime has amplified geopolitical instability considerably,” said Rob Cameron, founder of merchant bankers Cameron Partners. “Global political outcomes are more unpredictable.”

“His performance is so poor we can only hope for impeachment,” added a law firm head.

Despite the negativity towards the president, 80 per cent of those surveyed say their view of Trump’s performance won’t affect their own company’s intentions with the United States:

“Operating in the US isn’t easy, regardless of who is in power,” said a tourism boss. “The domestic economy actually feels very strong in the US from a business operating perspective.”

“It remains a key market for us, no matter the presidency. Therefore, we remain committed to the United States,” added Don Braid, Mainfreight’s group managing director.

Others cited the ability for the US Congress to moderate the actions of the President as offering reassurance:

“Fortunately, in the United States, the founding fathers designed a constitution with checks and balances. Despite the concerns about Trump gaining a lot of media attention, his ability to implement action is limited,” explained a major law firm partner.

“He is mercifully restrained by the constitution and the checks and balances in the system,” said Kate McKenzie, Chorus CEO.

Several executives in the real estate industry thought Trump was having a positive impact on their business, as he unintentionally makes New Zealand a more appealing environment:

“As more Americans look to diversify investment and lifestyle outside the US, New Zealand’s clean green image and welcoming economic and political environment makes us a favoured destination,” said one real estate chief executive.

Another commented: “Trump’s irrational behaviour makes New Zealand’s isolation one of our greatest strengths.”

Neil Paviour-Smith, managing director of Forsyth Barr thinks Trump will help New Zealand businesses to bolster its trade in other markets. “While the New Zealand economy is continuing its expansionary phase, we are seeing more synchronised growth globally – including former laggards Japan and the EU – despite a lot of distraction from geopolitical-related activities.”

Much of the comment was pungent. Simplicity’s Sam Stubbs predicts – “as the ultimate apprentice in the ultimate game show, he will be, ultimately, fired.”

Closer to home there was some criticism of New Zealand businessman Chris Liddell – a former chief financial officer at Microsoft and General Motors – who heads Trump’s strategic development group focusing on priority projects and liaison with the private sector.

“Trump is an absolute tosser! What is Chris Liddell doing there?” questioned Local Government Funding Agency chairman Craig Stobo.

Another added: “Though in talking with a prominent Kiwi in the White House, he believes Trump is a very clever person who knows business and will succeed – as long as he gives up the stupid tweeting and mind games over people.”

Though Liddell is still in the White House, the turmoil and unprecedented staff turnover in Washington and delays in filling key jobs in US Government departments, has been noted.

“A disastrous lack of leadership is leaving the United States increasingly rudderless,” said Beca’s Greg Lowe.

“Trump is worse than I thought he was going to be,” added a real estate executive.

The Trump administration has seen a number of high-profile staff leave the White House.

Recent departures include Sebastian Gorka, deputy assistant to Trump; chief strategist Steve Bannon; communications director Anthony Scaramucci – dismissed after only 11 days in the job – and chief of staff Reince Priebus.

But the new chief of staff, former marine general John Kelly, is said to be bringing discipline to the show.

Protectionism rears its head

One of Trump’s first actions as president was to throw out the TPP agreement which New Zealand signed in Auckland in February 2016 along with 11 other nations. During the 2016 presidential campaign, Trump frequently criticised TPP – labelling it “horrible,” a “bad deal,” and a “death blow for American workers”.

His new “America First” strategy has had a wide impact on US involvement in regional and multilateral trade agreements. The president favours individual deals on the proviso they can be quickly terminated in 30 days “if somebody misbehaves.”

He has recently stepped up calls for a more protectionist stance. Dismissing some of his top staffers as globalists, he has demanded a plan be drawn up to impose tariffs to remove China’s “unfair advantage” displayed by its trade surplus with the United States. “There is no dodging it, the world is more fearful and feels (but may not be yet) more protectionist,” says a senior player in the investment community.

“The move towards protectionism causes one to be more cautious and concerned about the outlook,” says Cathy Quinn, partner and former chair at MinterEllisonRuddWatts.

The protectionist stance also brings with it the possibility of border taxes, which some congressional Republicans have put forward to support Trump’s commitment to increase American competitiveness and prevent jobs shifting overseas.

This would mean companies could no longer deduct the cost of imports, creating strong incentives to retain and relocate supply chains and research to the United States. But there are fears this could spark a trade war, as countries move away from the US and source products and materials elsewhere.

Without a detailed proposal for border taxes, it is impossible to comment on the specifics. But chief executive respondents to the Herald survey indicated they are reasonably concerned about potential risks to exporters trading with the United States, rating this at 5.2/10.

“Implementation of the Border Adjustment Tax poses a very serious risk to New Zealand’s wine exports to the United States – our biggest export market – and will undoubtedly be damaging to the industry,” says Erica Crawford, founder and managing principal of Loveblock Wines.

Threat of nuclear war

There is no doubt the threat of nuclear war has escalated considerably since Trump became president.

Earlier this month, Pyongyang said it had successfully trialled a hydrogen bomb that could be loaded onto a long-range missile.

North Korean state television said the trial, which was ordered by leader Kim Jong-un was a “perfect success” and a “very meaningful step in completing the national nuclear weapons programme.” It received international condemnation – including from New Zealand’s Foreign Minister Gerry Brownlee, who called the test “utterly deplorable.”

As is customary, Trump responded by tweet: “North Korea is a rogue nation which has become a great threat and embarrassment to China, which is trying to help but with little success.”

This was followed by: “South Korea is finding, as I have told them, that their talk of appeasement with North Korea will not work, they only understand one thing!”

Trump didn’t expand on what that “one thing” might be, but at an unrelated event last month he promised to inflict “fire and fury like the world has never seen” upon the totalitarian state if it acted in a hostile manner.

It is not surprising then, that the potential for nuclear war in Asia was considered by CEOs to be of reasonable concern, rating at 5.9/10.

“North Korea is a serious issue, which would have come to a head with or without Trump. The problem is Kim Jong-un can’t be fired, only fired upon. This is not reality TV,” said Simplicity’s Stubbs.

The Trump Factor

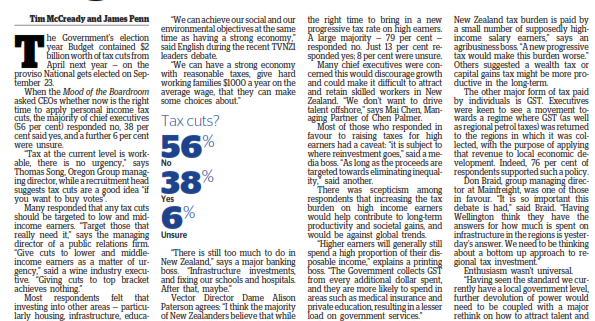

CEOs rated President Trump’s policy initiatives and actions on a 1 to 5 scale (where 1= not impressive and 5= very impressive).

- Implementing his campaign agenda including a radical cut to the corporate income tax to 15 per cent: 1.51/5

- Trump’s call for an “America First” trade policy with a focus on bilateral trade deals: 1.31/5

- Threats of a nuclear strike on North Korea: 1.30/5

- United States withdrawal from the Paris Climate Accord: 1.24/5

- Dealing with Russian security concerns: 1.24/5