Infrastructure: Looking at the opportunities for asset recycling (NZ Herald)

Asset recycling enables the Government to boost its available funds by either selling or offering a long-term lease of underutilised, inefficient, or surplus public infrastructure to investors in the private sector.

In exchange for the sale or lease of those assets, the Government can receive a large up-front, lump-sum payment.

Capital received from divestment can be used to revitalise existing assets, or fund new and critical infrastructure needs that might otherwise have been unfunded or funded using more traditional methods such as raising taxes or increasing public debt.

New South Wales

Since 2012, asset recycling has been one of the core principles of Australia’s New South Wales Government property policy.

The NSW Department of Premier and Cabinet says that “real property assets are only held by Government when required, and in the form necessary, to support core government service provision.”

Australia’s asset recycling has extended to the sale or long-term lease of public assets including ports, “poles and wires” electricity assets and its land titles registry, and has reached a combined value of A$53 billion.

Former NSW premier Mike Baird campaigned at the 2015 election on a platform of infrastructure investment, of which the recycling of assets was the method to achieve this.

Baird’s re-election demonstrated that asset recycling and new infrastructure funding mechanisms can be economically effective as well as politically popular – but they take leadership and vision.

A recent report on asset recycling by Property NSW showed overwhelming support for the NSW Government’s policy of recycling property assets to fund infrastructure and better services.

Of those surveyed, 71 per cent said they favoured leasing or selling under-utilised assets over more traditional measures, such as raising taxes or increasing levels of public debt.

Interest from the US

During his visit to Australia earlier this year, United States Vice-President Mike Pence told business leaders that the Trump administration hoped to emulate the Australian model of infrastructure asset recycling as part of the President’s US$1 trillion infrastructure plan.

New York’s LaGuardia Airport was cited by Pence as one example of an asset that had the potential to be redeveloped with the injection of private funds.

LaGuardia is so badly in need of upgrades, expansion and improvements that President Trump has referred to it as “like from a third world country”, contrasting it (and other US airports) to the “incredible airports” in Dubai, Qatar and China.

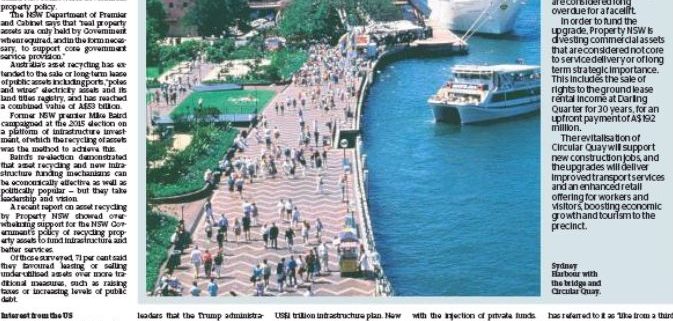

Upgrading Circular Quay

It is estimated that the number of jobs in the iconic Circular Quay precinct in Sydney will increase by around 4500 in the next 30 years.

The ferry wharves and adjoining promenade were built in the 1940s and are nearing the end of their life. They are also not compliant with the Disability Standards for Accessible Public Transport.

For these reasons, they are considered long overdue for a facelift.

In order to fund the upgrade, Property NSW is divesting commercial assets that are considered not core to service delivery or of long term strategic importance.

This includes the sale of rights to the ground lease rental income at Darling Quarter for 30 years, for an upfront payment of A$192 million ($215m).

The revitalisation of Circular Quay will support new construction jobs, and the upgrades will deliver improved transport services and an enhanced retail offering for workers and visitors, boosting economic growth and tourism to the precinct.

Viewpoint: Michael Barnett, Auckland Chamber of Commerce chief executive

It would easy to be populist and label it privatisation and kill another opportunity for Auckland. The reality is, existing funding models are failing us and we either need to find an innovative response to this or pay the price of a lack of investment in our infrastructure over the last 40 years with low productivity and community frustration.

Old style asset recycling was essentially selling one lot of assets to fund other priorities – this often meant selling an income generating asset to fund another asset that didn’t.

Today it’s about maintaining ownership control and not owning – an example of this could be with Ports of Auckland where the land and the business could be separated or perhaps an environment where an investor of “like values” might take partial ownership of an asset investing say on behalf of a superfund of New Zealanders with only the intention of investment and not for selling on.

Of course, any funds released should then be invested in our infrastructure needs (transport) – the important thing here would be to have a narrative that articulated the benefit to Auckland that may not be in cash but in productivity, employment opportunities and growth.

Viewpoint: Kim Campbell, Employers and Manufacturers chief executive

If we are to have sufficient funds for the development of Auckland’s growing infrastructure needs we will need to find more innovative funding devices.

The community appears allergic to rates, and tolling the roads is consistently blocked by central government. So what’s left?

Recycling of assets is a tried and proven device overseas where city assets are identified as being underused, redundant or inappropriate, and sold. The funds are immediately put to use for items which will increase the city’s overall productivity.

There are many such assets in Auckland. They may have some amenity value, but the benefits may accrue to a small part of the community. This includes shares in airports, golf courses, quarries, forests, transport corridors, water systems and theatres – to name a few.

Their sale is quite legitimate as long as the money is put to more productive use immediately. Often the sold assets become more productive under new owners as we have discovered with the sale of our electrical generation assets. NSW has a long and successful history of this, including Barrangaroo and White Bay.

Viewpoint: Paul Blair, Head of Institutional Banking, BNZ

BNZ is open to talking about ways to solve the big issues facing New Zealand. Countries and governments around the world are facing infrastructure challenges – New Zealand is not alone.

It is important to look at and consider potential ways to solve issues and have those challenging conversations, but any single “tool in the tool box” (like asset recycling) can’t be a silver bullet – multiple approaches and great collaboration is more likely to get a good result.

Governments face ever-rising demands for new and better enabling infrastructure. Asset recycling is one of the tools that have been used successfully in NSW and other overseas jurisdictions. New Zealand has an opportunity to learn from these case studies.

There are many other tools as well (including modern regulation of infrastructure sectors, centralised and specialist procurement, integrated planning, governance and finance, the use of incentives to encourage private sector and local government investment, etc) and a combination of approaches is likely to be needed as these are complex problems.

New Zealand is an extremely open economy. New and modern business models and exponentially expanding technology mean we are highly integrated into global business flows and trends which are changing at an unprecedented rate.

Business and society change is driven by new technology such as artificial intelligence, social media, robotics, data science, 3D printing as well as big macro shifts in demographics, infrastructure pressures and geo-political changes.

All of this change, coupled with government’s relatively limited risk appetite and the complexity of legislating for and regulating this change, means that governments need to look at alternative models to deliver the infrastructure required to meet New Zealand’s social and economic needs.