Auckland Mayor Wayne Brown is philosophical when asked to reflect on his time leading New Zealand’s biggest city.

“Well, it’s like a curate’s egg — it’s good in parts,” he laughs.

When Brown won the election in October 2022, he had anticipated the challenges ahead.

Acknowledging his frosty relationship with media, especially during the initial six months, Brown felt “quite a lot of the press were grieving over the fact the person they’d invested a lot of effort in didn’t make it.”

Tensions heightened during the devastating Auckland Anniversary floods. Criticised for showing a lack of empathy, he defends his approach: “People didn’t want empathy; they wanted an engineer to come out and tell them what to fix.

“I think eventually people saw that. While everyone was out wandering around and having empathy, I was providing engineering inputs.”

The media tone is now more even-handed, he says. “I just want it to be fair, and it wasn’t fair at the start.”

When it comes to the city’s finances, Brown highlights his own foresight: “I predicted that there would be a billion-dollar overrun on the City Rail Link.”

While he had no specific figures prior to the 2022 election, his hands-on experience meant he was aware there would be ballooning costs associated with the project.

“I also predicted during my campaign that interest rates would rocket and so would the cost of living.”

He says one of the advantages he brings to the job is that he has had, and continues to have, businesses “from Hawke’s Bay to Kaitāia”.

“My consulting engineering and building and construction businesses have made me interact with councils all my life, so I am deeply embedded in understanding from both sides of the fence what councils do.”

While Brown views his diverse business experience as an advantage, he is frustrated with the lack of practical, real-world experience among his council peers. “I come with way more knowledge than anyone sitting around me at the table. Some of them have been here for 15 years and pretty much learned nothing,” he claims.

He contrasts this with councillors in the Far North, where he was previously mayor. “The councillors up there are part-time. They go back to their farms, orchards, mechanic workshops, dairies… whatever.

“None of them need to be told by an economist that people aren’t buying as much as they used to, or that prices are going up. They can see it for themselves.”

He describes his fellow councillors as “nice people”, but says they are “full-time, political, and unfortunately some are not directly invested in the daily activities of the city”.

Brown considers the $375 million hole in last year’s budget as his first and greatest challenge.

Last-minute changes were made to the budget, including selling fewer shares in Auckland Airport than he would have liked, and, nudging household rates bills above inflation.

After nearly two days of debate, he secured support from a sizeable majority of councillors. “In the end, we got it through — that was a high point, but also the first real test.”

Get Wellington out of Auckland

Brown is staunchly apolitical.

He is proud of the fact that he has worked with and maintains a good relationship with former Prime Ministers Helen Clark and Sir John Key.

Despite the change from a Labour government to the Coalition Government, his message remains consistent: ‘Get Wellington out of Auckland’.

“The message that the public love, but is not being heard well in Wellington, is that Auckland needs to decide Auckland,” Brown says.

“I’m not going to change. I have very strong views on infrastructure, roads, power supplies. These are things that I know a lot about.”

One of the changes introduced during the Government’s first 100 days was the cancellation of the Regional Fuel Tax (RFT) in Auckland, which will leave a shortfall in transport funding for Auckland of $1.2 billion over the next four years. The loss in revenue will mean that Auckland Council’s debt-to-revenue ratio will increase, meaning the council has less ability to borrow when it needs to.

Curia Market Research Poll commissioned by the Office of the Mayor found that 44 per cent of Aucklanders want to keep the RFT. Only 26 per cent were in favour of cancelling RFT projects, and just 22 per cent favoured increasing rates to make up the shortfall in funding.

“It is very easy to remove things, but you’ve got to put something back,” says Brown, noting that the council is still working out what RFT projects will be cut. “One of the things it was going to fund was the battery chargers that will be needed for the electric ferries. That’s going to make the electric ferries look like a clever investment, isn’t it?”

While the Government might insist it campaigned on the RTF removal, Brown says it didn’t campaign on forcing the mayor to put rates up to cover the losses.

“I am not going to do that. We will just have to do less.”

Turning to the Government’s roads of national significance, Brown points out that the roads outlined for Auckland in the Government Policy Statement (GPS) on Land Transport don’t align with his priorities for the city, and some of them have terrible benefit-cost ratios.

Roads planned for Auckland are Mill Road in south Auckland and the East-West Link connecting state highways 1 and 20 through Onehunga to relieve road freight congestion.

Brown pushes back on what he jokingly refers to as “roads of National Party significance”, insisting they should not supersede priorities identified by the Auckland integrated transport plan.

“This is my city. I was elected by people from every part of this city,” Brown says.

“The political party I stand for is Auckland, I am here for Auckland, and particularly the ratepayers.”

“I am insisting on being treated as a regional government, because that is what we were set up as.”

Looking ahead

With 18 months left on the clock, Brown has a lot he wants to achieve.

A bold vision to establish a new regional wealth fund that he insists will provide a better return on investment from Auckland Council’s assets is a priority.

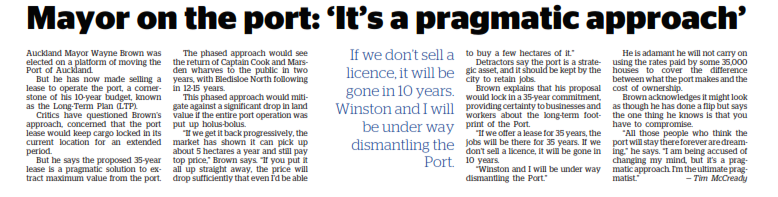

The Auckland Future Fund’s initial capitalisation of $3-4 billion would come from the proposed sales of an 11 per cent shareholding in Auckland International Airport and the proceeds from a 35-year lease to run Port of Auckland.

Brown says the fund would achieve more for ratepayers’ money. He points out that ratepayers get just over 2 per cent in annual returns for its stake in Port of Auckland. The city’s remaining shares in Auckland International Airport are projected to return less than 2 per cent in dividends in the coming year.

Brown also claims a diversified portfolio would spread the financial risk for Auckland in the event of another flood (which significantly impacted the airport) or a tsunami (which he asserts could damage the port).

That portfolio would make provision for climate change risks through self-insurance and help mitigate rates rises for Aucklanders.

The fund will be voted on by councillors as part of council’s long-term plan, which is currently out for public consultation.

“Those that vote against it will be voting against helping those people who flood next time because the cupboard will be bare,” Brown says.

When it comes to transport, he expects to have the first trial up and running of time-of-using charging, aimed at reducing congestion and speeding up travel times throughout the city. A flat fee, charged a maximum of twice a day and only at peak times, is expected to make motorways function all year round as they do on school holidays.

“We will also have at least two or three of the dynamic lanes in place,” he says, referring to roads that use signs and lights to change the direction of centre lanes at peak times to improve traffic flow.

“People will start to see things happen, otherwise there will be wholesale changes at Auckland Transport, I tell you.”

Brown says he is working hard to stop the “disjointed thinking” going on behind the scenes in planning departments that the public might not see, but he thinks can provide big value to the city — economically and environmentally.

As an example he cites planning departments that restrict the amount of metal that comes out of quarries for environmental reasons: “But the environment they’re protecting by taking less out of a quarry is destroying the environment because the demand for that stuff remains and now trucks have to go twice as far — how does that help the environment?”

Another priority for Brown is reducing council costs. He envisions a streamlined governance structure for the city, with a reduced number of councillors and local boards. Auckland currently has 21 local boards with between five and nine members elected to represent their geographic area. Including the mayor and 20 councillors, this means there are 170 elected members in the region.

“How can that be necessary? How can that be justified?” Brown asks.

He jokes: “How can anyone even know who they are? You can go through life and not meet that number of people!”

Brown says that in principle, “councillors agree that there are too many councillors and we should reduce it — as long as it is the others and not themselves.”

Looking toward the elections in 2025, Brown says his message for business leaders is simple: “You’ve got a business leader as Mayor. Don’t waste the opportunity, it may not happen again.

“We’ve got all sorts of failed politicians lining up who haven’t got an income, trying to use their name recognition to get themselves a job. I’m not here for the income.”