Mood of the Boardroom: Strong start for Nicola Willis, business leaders urge focus on growth (NZ Herald)

The boardroom is calling for more than just fiscal prudence. Business leaders want a more ambitious, clearly articulated plan and a more engaged approach with the business community.

The Mood of the Boardroom 2024 reveals that 78% of top CEOs and directors responding to the NZ Herald’s survey are confident in Finance Minister Nicola Willis’ economic leadership, while 8% are not, and 14% remain uncertain.

Willis has had a swift rise to one of the Government’s top jobs.

She entered Parliament in 2018, after holding senior management roles at Fonterra focused on global trade strategy. Following Judith Collins’ ousting as National leader in 2021, Willis became deputy leader under Christopher Luxon.

In 2022, she took over the finance portfolio from Simon Bridges, and following the 2023 election was appointed New Zealand’s 43rd Minister of Finance in the new coalition Government.

Willis also serves as Minister for the Public Service, Minister for Social Investment, and Associate Minister of Climate Change.

She delivered her first Budget in May, calling it the “clean-up job New Zealand needs”. Despite critics from some quarters, she upheld National’s key campaign promise of tax cuts. Funded through significant public sector savings and targeted revenue measures, Willis’ approach was seen as a balancing act between fiscal responsibility and delivering on voter expectations.

Jarden managing director Silvana Schenone says she brings a refreshed and realistic perspective to the challenges New Zealand faces.

“She is competent and confident, but has major challenges ahead of her,” says a lobbyist, capturing the general sentiment of cautious optimism.

Others are reserving judgment, citing the early stage of her tenure.

“Almost a third of the way in, and I still want to say ‘early days,’ so perhaps that means I’m not confident yet,” says the head of a professional services firm, reflecting a wait-and-see attitude among certain business leaders.

Deloitte CEO Mike Horne echoes this sentiment: “Tentative at this point.

“She has faced into some of the fiscal issues that she inherited but as yet, we haven’t seen a clear direction on how to move forward to a more sustainable, longer-term solution.”

Willis’ dedication and work ethic have not gone unnoticed.

“She is an extremely hardworking minister who has taken the tough, politically risky calls,” commends Freightways chair Mark Cairns, a member of the Ministerial Advisory Group tasked with providing independent advice on the future of KiwiRail’s inter-island ferry service.

The issue remains unresolved, with two rail-enabled ferries initially scheduled for delivery in 2026 under a plan agreed to by the Labour-New Zealand First coalition in 2018. Since the Coalition Government required KiwiRail to cancel the ferry contract nine months ago, the future of the country’s inter-island ferry service remains unresolved.

Willis’ focus on fiscal discipline is applauded. Her efforts to cut Government spending and seek efficiencies in public service delivery are seen as necessary first steps.

“The Finance Minister inherited a hospital pass from the previous Government,” says Roger Partridge, chair of The New Zealand Initiative.

“After two decades of cross-party support for fiscal responsibility, her predecessor threw that consensus out the window with his post-Covid budgets.”

Partridge emphasises the need for the Government to restore New Zealand’s reputation for fiscal prudence while ensuring economic resilience in the face of potential future challenges.

An executive from the energy sector describes Willis’s start as “solid”, acknowledging her limited executive experience but recognising she has been quick to get up to speed.

“Cost-cutting and getting the Government house in order is a hygiene factor. She is developing fast and there is much to be hopeful about. She has great presence countering for the Prime Minister’s absence within the business community.”

A balancing act: caution vs ambition

Despite the strong support for Willis, CEOs and directors do not hold back feedback that recognises her accomplishments while also highlighting areas that need more focus.

The boardroom is calling for more than just fiscal prudence. Business leaders want a more ambitious, clearly articulated plan and a more engaged approach with the business community.

Chris Quin, CEO of Foodstuffs North Island, appreciates Willis’s efforts to curb excessive Government spending but adds: “It would be good to hear more from the Government about their economic growth story. New Zealand doesn’t feel like an easy place to do business right now.”

An agribusiness leader agrees, highlighting the need for a growth strategy: “Cutting costs in wasted areas is one thing, but we need to grow the economy. Be clear on those spend areas and how they will contribute to growth.”

This call is echoed by a major law firm CEO, who believes Willis needs to have a greater focus on growth areas, not just cuts in Government spending.

“The five pillars are good, but where is the meat on the bone?” asks one public sector CEO, referring to the Government’s economic strategy — building infrastructure for growth and resilience; lifting educational achievement and skills; strengthening trade and investment; promoting innovation, science, and technology; and improving regulation — but pointing to a lack of detailed plans to back them up.

KiwiRail CEO Peter Reidy urges Willis to “engage and listen — be open to alternative perspectives to help Government make considered choices that impact international reputation and exporter/importer confidence.”

This is a sentiment shared by many who believe that more decisive communication and transparency on key issues are critical to building trust.

A construction boss advises: “Communicate the steps of the plan, this is critical to gaining confidence in the plan for improvements.”

However, there is also criticism of recent policy decisions, particularly around tax cuts and property investment incentives. The reinstatement of full interest deductions for residential property, costing $2.9 billion — over $800 million more than what National had originally budgeted — has been contentious.

“Prioritisation of property investment versus investment in the productive economy is concerning,” says Uno Loco CEO Blair Glubb, who wants to see more pragmatic incentives for business growth.

“Infrastructure vs tax cuts?” asks Bagrie Economics managing director Cameron Bagrie. “The choice was pretty simple, but populism dictated.”

Long-term investment and social responsibility

Willis has established a Social Investment Agency, charged with working across government departments to intervene early and break cycles of dependence, intergenerational poverty, and disadvantage.

It is also responsible for ensuring that the $70 billion in Government spending on social services delivers meaningful results and ensures a focus on the Government’s public service targets.

From 2025, the agency will have $12 million annually to fund services from community groups, iwi, and NGOs.

Last month, Police Commissioner Andrew Coster was appointed as head of the new agency, a role considered highly influential because of the agency’s significance to the Government and Willis.

The need for further investment in infrastructure and social areas is a recurring theme among respondents.

Morrison CEO Paul Newfield sees a broader scope for Willis’ vision, advocating for policies that will improve New Zealand’s long-term economic and social well-being over the next two decades.

“Better education, increasing savings rates and high-quality density in our major cities that will result in more affordable housing with better infrastructure,” he suggests as priorities.

Harcourts Group managing director Bryan Thomson wants a clear path for investment in social housing and support for those less fortunate. “The economic reforms won’t work if people are left behind,” he warns.

As Willis navigates the complexities of her role, the business community remains optimistic, hopeful that her actions to date will evolve into bold, transformative action.

They say with the right balance of fiscal discipline and visionary leadership, there is potential for her to drive lasting positive change in New Zealand’s economic landscape.

Mood of the Boardroom: How CEO’s rate Labour’s Barbara Edmonds (NZ Herald)

Mood of the Boardroom: How CEO’s rate Labour’s Barbara Edmonds (NZ Herald)

Barbara Edmonds, Labour’s first female finance spokesperson, has stepped into the spotlight as she begins to reshape the party’s economic vision.

She is known for her pragmatic approach, clear communication, and ability to connect financial policy to real-world outcomes.

The NZ Herald’s Mood of the Boardroom survey asked New Zealand’s top executives whether Edmonds presents herself as a credible future Minister of Finance. The results show that she is in a formative stage of her political journey.

Just over 32% of respondents say Edmonds is a credible future Minister of Finance, with a similar number either unsure (35%) or unconvinced (33%).

While some business leaders applaud her approach and genuine engagement, there is still a perception that she remains untested and relatively unknown in the public eye; hardly surprising after a mere seven months in the role.

Several highlight her ability to connect with business leaders and demonstrate a strong grasp of economic issues.

“She’s a breath of fresh air,” one CEO says.

Described as possessing both “smarts and empathy”, she has been praised for reaching out to business figures in ways Labour has struggled to in recent years.

Path to politics

Representing Wellington’s Mana electorate, Edmonds brings a combination of lived experience and technical expertise to the finance role.

She worked as a specialist tax lawyer at Inland Revenue and later as an IRD seconded adviser to National Cabinet Ministers Michael Woodhouse and Judith Collins when they successively held the revenue portfolio.

Edmonds left IRD and spent time as a political adviser to former Labour Minister Stuart Nash before entering Parliament at the 2020 election.

She earned wide respect across Parliament, including from then National Opposition leader Chris Luxon, for her chairmanship of Parliament’s powerful Finance and Expenditure committee.

Her political career accelerated under Chris Hipkins’ prime ministership, where she held multiple portfolios including revenue, economic development, Pacific peoples, and associate roles in finance, housing, and cyclone recovery.

Taking over from Grant Robertson, she is not only her party’s first female finance spokesperson but also the first Pasifika person in the role.

Her professional background in tax is also noted as a key strength, positioning her as a pragmatic counter to the ideological bent that some felt defined the last Labour government.

Comments such as “I met Barbara recently and she showed an impressive grasp of the issues”, from Foodstuffs North Island CEO Chris Quin, and “she asks ‘what is the worst thing we could do?’, which is highly unusual but also refreshing and rebuilding confidence,” from a lobbyist, illustrate that Edmonds can win over sceptics with her approach.

However, Edmonds has hurdles to overcome.

A recurring theme from the boardroom is her lack of visibility. Many respondents say they haven’t seen enough of her to form a full opinion.

Some note that while Edmonds shows potential, she is still learning and has yet to fully define her economic stance. “Untested” and “unknown” are words used frequently by respondents, with an energy CEO asking: “What does she stand for economically?”

Executives tell Edmonds where to focus

Edmonds says her background has profoundly shaped her political perspective.

After her mother died when she was 4, her father left his job to raise his children on a benefit. Now, as a mother of eight, she draws on her lived experience to connect with the struggles of many New Zealand families.

In her post-Budget speech earlier this year, Edmonds described her pathway to finance spokesperson through her experience at three different tables: the kitchen table, where she balanced the family budget while completing university assignments; the boardroom table from her career in the private sector; and the Cabinet table, where she was responsible for managing taxpayer dollars.

As Edmonds takes on a central role in shaping Labour’s renewed policy agenda, the boardroom is clear about where they feel her focus should be.

A consistent theme was the need for Labour to embrace economic growth as a priority.

A retail boss notes: “Labour needs to talk more about growing the size of the pie, improving New Zealand’s economic performance so we can enjoy high living standards.”

There was a strong feeling that Edmonds must move away from policies focused solely on redistribution of wealth and instead look to boosting productivity and innovation, which many feel has been neglected in recent years.

Labour’s relationship with the business community also came under scrutiny, and rebuilding trust remains a significant task.

Barfoot & Thompson managing director Peter Thompson advises: “Labour needs to become more business dominant than it has been under previous finance ministers.”

The message from the boardroom is clear: Edmonds needs to show that Labour is not at war with business but rather working alongside it to foster a competitive economic environment. As Pernod Ricard’s commercial managing director, Kevin Mapson, puts it: Labour should aim for “creating a business environment that stimulates growth.”

Tax reform

Tax reform emerged from executives as one of the most talked-about issues when asked what should be on Edmonds’ agenda. Several business leaders say Edmonds’ background in tax policy is a strength, though some were concerned about how Labour will sell reforms like a capital gains tax to the electorate.

“A capital gains tax could be sold, but it would require real deftness and a tax switch that looked pro-business,” one CEO comments.

A banking boss warns: “She will be forced to sell their tax reform idealism but needs to bring business pragmatism to the discussion.”

Fiscal responsibility and the efficiency of government spending also feature prominently, with frustration with what some view as excessive spending from Labour in the past.

“Government’s wasteful spending programmes, public sector bloat,” notes a logistics boss, while another calls for “sensible use of public funds” and a clear plan to address productivity gaps.

Edmonds will need to present Labour as a party that can manage the economy with discipline.

As Bagrie Economics’ Cameron Bagrie sums up: “Rebuilding Labour’s credibility as reasonable economic managers — that credibility has been lost.”

Beyond economic and tax policy, other respondents urged Edmonds to tackle some of New Zealand’s most pressing issues.

“She needs to focus on infrastructure, education, and productivity,” advises the head of an industry association, reflecting a wider sentiment that Labour must address core public services without ideological distractions.

This pragmatic approach was echoed by chair of The New Zealand Initiative, Roger Partridge: “Move away from centralisation. Empower local governments and communities while ensuring proper incentives and accountability.”

There is also a growing call for Labour to take a longer-term view of New Zealand.

KiwiRail CEO Peter Reidy suggests that Labour outlines “what we need for New Zealand in 2040. A 15 to 20-year vision,” rather than falling into the trap of short-term political fixes.

A professional director urges Labour to focus on “multi-period challenges for New Zealand,” demonstrating leadership where the current Coalition Government has been seen as weak.

With Labour facing a pivotal period of repositioning, Edmonds has an opportunity to redefine the party’s economic narrative.

Business leaders say her empathy, expertise, and fresh perspectives could help Labour connect more meaningfully with the business community and the broader electorate.

However, to solidify her credibility as future finance minister, she will need to step into the public eye more prominently and communicate Labour’s economic vision.

As a banking sector CEO puts it: “Barbara is an absolute class act who possesses an equal balance of smarts and empathy.

“Quite the unicorn.”

But as Labour prepares for 2026, Edmonds will need to show she’s not only unique but ready to lead.

Mood of the Boardroom: Act Party leader David Seymour strikes right note with CEOs (NZ Herald)

Mood of the Boardroom: Act Party leader David Seymour strikes right note with CEOs (NZ Herald)

Act Party leader David Seymour’s performance since the 2023 general election has been met with mostly positive reviews from the business community.

Rated at 3.4/5 by respondents to this year’s Mood of the Boardroom survey, on a scale where 1 represents “not impressive” and 5 “very impressive,” his clear, pragmatic approach resonates with many executives.

However, not all are supporters.

A professional director believes Seymour has become too extreme in his views and is losing support from many of those who may have voted for him in his electorate.

“This divisive approach needs to end; this is not the Kiwi way,” she says.

Business leaders have provided a cautiously positive response to Seymour’s establishment of a Ministry of Regulation, intended to improve the quality and performance of regulatory systems across the government.

The ministry’s new Strategic Intentions document outlines its mission as “improving the regulations imposed by the Government, making them better, more streamlined, and easier for New Zealanders to navigate.”

Scoring the ministry’s importance at 3.51/5, many respondents see it as a potential driver of future economic growth and something that is urgently needed in New Zealand.

“Cut the red tape and let us get on with turning the economy around,” comments a logistics boss.

A professional director acknowledges that “intelligent management of regulation is very challenging but critically important”.

Deloitte chair Thomas Pippos echoes this sentiment, noting that New Zealand’s over-regulation “creates a deadweight cost on the economy”.

However, the boardroom is reserving judgment on the ministry’s effectiveness, citing a lack of progress.

“It is important, but it hasn’t achieved anything yet — there should have been some quick wins by now,” says a professional director.

An infrastructure executive agrees, stating: “It is moving too slow and needs to act with more urgency. Bureaucracy is costing New Zealand a significant amount.”

There were also calls for the ministry to focus on significant economic issues rather than what some perceive as minor concerns.

The ministry’s first two sector reviews are currently underway, considering early childhood education and agricultural and horticultural products.

A law firm CEO asks: “Probably important, but hasn’t achieved anything. Why prioritise early childhood education?”

Others emphasised the need for a balanced approach to regulation.

Foodstuffs North Island CEO Chris Quin stresses that regulation is crucial for keeping high standards, ensuring there are safeguards, and making sure everyone is playing fair.

“Good governance gives us credibility and reassures investors that we’re a good place to do business and to invest in,” he says. “The key is striking the right balance — regulation should benefit consumers and boost competition, without scaring off investment.

“We don’t want to be the Wild West, but we don’t want to be so regulated we stifle growth and innovation either. Robust cost-benefit analysis of key regulatory decision is key.”

Despite support for the ministry’s mandate, there are concerns about its implementation and Seymour’s broader political agenda.

“The Ministry of Regulation feels like a way to justify having a voice on all major legislation,” says an investment executive.

“If Seymour was really focused on long-term economic growth and productivity, that would be fine, but his obsession with divisive social issues that energise people on the fringes of the New Zealand political debate make him the wrong person to wear that badge.”

The head of a professional services firm suggests there is a need for a more comprehensive approach.

“I wouldn’t have set this up as a ministry that cherry-picks sectors for review and change. I would have required every agency of government to outline why certain regulations are still necessary and drive system-wide multi-sector change at pace with economic growth and productivity the determining factor.”

There has also been criticism over the ministry’s average salary of $154,500 for its staff, which some view as contrary to the coalition Government’s pledge to reduce back-office spending.

“I am truly appalled at the news of pay rates within the ministry,” a public sector CEO says.

Mood of the Boardroom: Labour Party leader Chris Hipkins’ low profile, low ratings (NZ Herald)

Mood of the Boardroom: Labour Party leader Chris Hipkins’ low profile, low ratings (NZ Herald)

After Jacinda Ardern’s unexpected resignation in early 2023, Chris Hipkins was the sole nominee for Labour’s leadership.

Following nine months as Prime Minister, Labour was swept out of power, but Hipkins has held on, continuing as party leader and leader of the Opposition.

His performance in this role has been met with lukewarm reviews from business leaders in this year’s Mood of the Boardroom survey. They give him a score of 2.26/5 on a scale where 1 represents “not impressive” and 5 “very impressive”.

A tough position in the political cycle

Several executives acknowledge the inherent difficulties that come with the job of Opposition leader during the first term of a new Government.

“It is always hard to get media cut-through in the first term,” observes KiwiRail CEO Peter Reidy, noting that Hipkins is beginning to position Labour’s view of the future and address tough choices related to increasing superannuation costs.

However, there is a sense that his efforts have yet to resonate widely.

“Being Opposition leader isn’t easy, and the media chipping machine has started on him,” observes an industry association CEO. “But laying relatively low for now isn’t silly. Criticism too early on just looks like sour grapes and gets the valid response, ‘well, why didn’t you do it then?’”.

Others echo this sentiment, believing Hipkins is taking a measured approach and biding his time until the political winds shift.

“He can only make limited headway and will be focused on where the party positions itself in the future,” says Foodstuffs North Island CEO Chris Quin. “I wouldn’t expect him to be making serious inroads into the coalition’s programme at this point in the cycle.”

Despite this pragmatic approach, concerns persist regarding Hipkins appearing disconnected and struggling to gain traction on critical national issues.

“Chris who?” quips a professional services CEO. “I understand the difficulty of getting media share in Opposition, but he is missing in action on key messages and issues”.

This sums up a common feeling among respondents. Describing him as “failing to fire” and noting it is “hard to tell if he is enjoying life at the moment”, many suggest there is a lack of enthusiasm and leadership presence.

“It’s a tough job, but you get the sense he’s just another Wellington bureaucrat,” adds a banking boss.

However, not all feedback is negative.

“He is quite effective in Opposition,” a professional director says.

Still reeling

The consensus is that the party is still reeling from the election loss and has yet to regroup effectively. Labour received 26.9% of the vote, compared to National’s 38%.

“The Opposition has yet to accept the reasons for its defeat in 2023,” says NZ Windfarms director Craig Stobo. “Until they digest that result, they will struggle to articulate what Labour now stands for.”

To regain credibility by the next election cycle, some business leaders advise that Labour adopt a more moderate policy approach.

“Moderation in policies, not lots of race-based ideas or ‘soak the rich’ type agendas to impress their base,” says one CEO, recommending Labour take cues from UK Labour Leader and new Prime Minister, Sir Keir Starmer.

They emphasise the importance of laying the groundwork: “Labour needs to do the policy mahi now so that in 2026 they have a suite of credible things to campaign effectively.”

Expecting more from the frontbench

Labour’s highest-ranking MPs have also struggled to make an impression, with key figures within the party receiving relatively low ratings across the board. Respondents rated the political performance of Labour’s frontbench on a scale where 1 represents “not impressive” and 5 “very impressive”:

2.76/5 – Kieran McAnulty (Housing, Local Government, Regional Development)

2.74/5 – Barbara Edmonds (Finance, Infrastructure)

2.40/5 – Ayesha Verrall (Health, Public Service, Wellington issues)

2.33/5 – Chris Hipkins (Leader, Ministerial Services, National Security and Intelligence)

2.26/5 – Carmel Sepuloni (Social Development, Pacific Peoples, Child Poverty Reduction)

2.23/5 – Megan Woods (Climate Change, Energy, Resources)

2.15/5 – Ginny Andersen (Police, Prevention of Family and Sexual Violence, Social Investment)

1.94/5 – Willie Jackson (Māori Development, Broadcasting and Media, Employment)

1.93/5 – Willow Jean Prime (Children, Youth)

1.86/5 – Jan Tinetti (Education, Women)

Mood of the Boardroom: Greens, Te Pāti Māori political leaders face mixed ratings (NZ Herald)

Mood of the Boardroom: Greens, Te Pāti Māori political leaders face mixed ratings (NZ Herald)

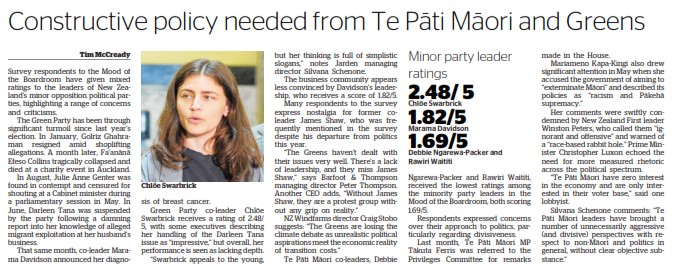

Survey respondents to the Mood of the Boardroom have given mixed ratings to the leaders of New Zealand’s minor opposition political parties, highlighting a range of concerns and criticisms.

The Green Party has been through significant turmoil since last year’s election. In January, Golriz Ghahraman resigned amid shoplifting allegations. A month later, Fa’anānā Efeso Collins collapsed and died at a charity event in Auckland.

In August, Julie Anne Genter was found in contempt and censured for shouting at a Cabinet minister during a parliamentary session in May. In June, Darleen Tana was suspended by the party following a damning report into her knowledge of alleged migrant exploitation at her husband’s business.

That same month, co-leader Marama Davidson announced her diagnosis of breast cancer.

Green Party co-leader Chlöe Swarbrick receives a rating of 2.48/ 5, with some executives describing her handling of the Darleen Tana issue as “impressive” but overall, her performance is seen as lacking depth.

“Swarbrick appeals to the young, but her thinking is full of simplistic slogans,” Jarden managing director Silvana Schenone notes.

The business community appears less convinced by Davidson’s leadership, who receives a score of 1.82/5.

Many respondents to the survey express nostalgia for former co-leader James Shaw, who was frequently mentioned in the survey despite his departure from politics this year.

“The Greens haven’t dealt with their issues very well. There’s a lack of leadership, and they miss James Shaw,” Barfoot & Thompson managing director Peter Thompson says.

Another CEO adds, “Without James Shaw, they are a protest group without any grip on reality.”

NZ Windfarms director Craig Stobo suggests: “The Greens are losing the climate debate as unrealistic political aspirations meet the economic reality of transition costs.”

Te Pāti Māori co-leaders Debbie Ngarewa-Packer and Rawiri Waititi received the lowest ratings among the minority party leaders in the Mood of the Boardroom, both scoring 1.69/5.

Respondents expressed concerns over their approach to politics, particularly regarding divisiveness.

Last month, Te Pāti Māori MP Tākuta Ferris was referred to the Privileges Committee for remarks made in the House.

Mariameno Kapa-Kingi also drew significant attention in May when she accused the Government of aiming to “exterminate Māori” and described its policies as “racism and Pākehā supremacy.”

Her comments were swiftly condemned by New Zealand First leader Winston Peters, who called them “ignorant and offensive” and warned of a “race-based rabbit hole.” Prime Minister Christopher Luxon echoed the need for more measured rhetoric across the political spectrum.

“Te Pāti Māori have zero interest in the economy and are only interested in their voter base,” one lobbyist said.

Silvana Schenone comments: “Te Pāti Māori leaders have brought a number of unnecessarily aggressive (and divisive) perspectives with respect to non-Māori and politics in general, without clear objective substance.”

Mood of the Boardroom: War in Taiwan could hit New Zealand trade hard, executives say (NZ Herald)

Mood of the Boardroom: War in Taiwan could hit New Zealand trade hard, executives say (NZ Herald)

Executives were asked in the Herald’s Mood of the Boardroom survey whether they are concerned the China-Taiwan conflict could escalate into war and if it would affect New Zealand’s interests.

Some 68% of business leaders say they are concerned. The remaining 22% are not, while 10% say they are unsure.

China’s significance to New Zealand’s economy means any disruption to trade would have far-reaching effects.

Barfoot & Thompson managing director Peter Thompson reflects this concern.

“China is a big player for New Zealand business, and if war broke out, trade deliveries would be slowed, having a huge impact on businesses back here, similar to during the Covid period.”

Complicating matters further is the delicate geopolitical balancing act New Zealand faces.

“Our two biggest trading partners at war with each other would be a nightmare for New Zealand,” warns NZ Windfarms Director Craig Stobo, referring to the United States, which last year overtook Australia to become New Zealand’s second-largest trading partner, and highlighting the complexity of New Zealand’s position.

Despite this anxiety, some respondents are confident that the situation will not escalate.

Les Morgan, who runs the Sudima hotel chain in New Zealand, trusts that “the economic impacts of such action will temper any desire to pursue formal action”, while a logistics executive suggests that “China will not invade Taiwan, they will get control economically over the century”.

Some have broader concerns over inadvertent escalation.

“I worry about the likelihood of a proxy conflict or miscalculation leading to conflict,” a public sector CEO says.

The long-term implications of such a conflict go beyond mere trade disruptions.

“The risks associated if China and Taiwan go to war extend far beyond the region, with profound economic, military, humanitarian, and diplomatic consequences,” the New Zealand head of a US-headquartered multinational says.

Others note that while New Zealand may not be directly involved, the country must be prepared for the fallout from any escalation.

Deloitte chair Thomas Pippos warns: “This is a real risk, with care required to ensure matters don’t escalate to that level — accepting that New Zealand will not be the cause or protagonist.”

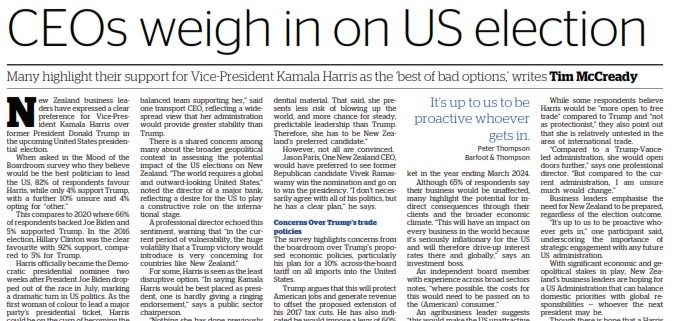

Mood of the Boardroom: Kamala Harris leads among NZ CEOs in US presidential election preference (NZ Herald)

New Zealand business leaders have expressed a clear preference for Vice-President Kamala Harris over former President Donald Trump in the upcoming United States presidential election.

When asked in the Herald’s Mood of the Boardroom survey (out tomorrow) who they believe would be the best politician to lead the US, 82% of respondents favour Harris, while only 4% support Trump, with a further 10% unsure and 4% opting for “other”.

This compares to 2020 where 66% of respondents backed Joe Biden and 5% supported Trump. In the 2016 election, Hillary Clinton was the clear favourite with 92% support, compared to 5% for Trump.

Harris officially became the Democratic presidential nominee two weeks after President Joe Biden dropped out of the race in July, marking a dramatic turn in US politics. As the first woman of colour to lead a major party’s presidential ticket, Harris could be on the cusp of becoming the first female President of the United States. Despite this strong preference for Harris, the excitement for her from New Zealand’s business community is subdued.

Others note that, while Harris presents a “less risky” option compared to Trump, she has yet to prove herself as a strong leader on the global stage.

“Harris would bring a more balanced approach due to having a more balanced team supporting her,” said one transport CEO, reflecting a widespread view that her administration would provide greater stability than Trump.

There is a shared concern among many about the broader geopolitical context in assessing the potential impact of the US elections on New Zealand. “The world requires a global and outward-looking United States,” noted the director of a major bank, reflecting a desire for the US to play a constructive role on the international stage.

A professional director echoed this sentiment, warning that “in the current period of vulnerability, the huge volatility that a Trump victory would introduce is very concerning for countries like New Zealand”.

For some, Harris is seen as the least disruptive option. “In saying Kamala Harris would be best placed as president, one is hardly giving a ringing endorsement,” says a public sector chairperson.

“Nothing she has done previously in her career suggests strong presidential material. That said, she presents less risk of blowing up the world, and more chance for steady, predictable leadership than Trump. Therefore, she has to be New Zealand’s preferred candidate.”

However, not all are convinced.

Jason Paris, One New Zealand CEO, would have preferred to see former Republican candidate Vivek Ramaswamy win the nomination and go on to win the presidency. “I don’t necessarily agree with all of his politics, but he has a clear plan,” he says.

Concerns over Trump’s trade policies

The survey highlights concerns from the boardroom over Trump’s proposed economic policies, particularly his plan for a 10% across-the-board tariff on all imports into the United States.

Trump argues that this will protect American jobs and generate revenue to offset the proposed extension of his 2017 tax cuts. He has also indicated he would impose a levy of 60% or more on Chinese imports.

Economists warn that this would likely backfire, essentially acting as a tax on US consumers and potentially adding around US$1700 ($2700) a year in additional costs.

Among New Zealand CEOs and directors, 30% say the tariff would directly impact their businesses.

This is particularly concerning given New Zealand’s growth in trade with the United States.

In 2023, bilateral trade between the two countries grew 16% to reach $14.6 billion, and saw the United States surpass Australia to become New Zealand’s second-largest export market in the year ending March 2024.

Although 65% of respondents say their business would be unaffected, many highlight the potential for indirect consequences through their clients and the broader economic climate. “This will have an impact on every business in the world because it’s seriously inflationary for the US and will therefore drive up interest rates there and globally,” says an investment boss.

An independent board member with experience across broad sectors notes, “where possible, the costs for this would need to be passed on to the (American) consumer”.

An agribusiness leader suggests “this would make the US unattractive as a market,” warning that it could cause massive instability globally. Anne Gaze, founder of Campus Link Foundation, sums up the general sentiment: “Such a policy would likely prompt us to explore alternative markets while navigating the added costs of US trade.”

Trade benefits possible with Harris

When asked whether a Harris-led US administration would open doors further for New Zealand trade, the response was divided: 28% believe it would, 26% say it would not, and 46% are unsure.

While some respondents believe Harris would be “more open to free trade” compared to Trump and “not as protectionist,” they also point out that she is relatively untested in the area of international trade.

“Compared to a Trump-Vance-led administration, she would open doors further,” says one professional director. “But compared to the current administration, I am unsure much would change.”

Business leaders emphasise the need for New Zealand to be prepared, regardless of the election outcome.

“It’s up to us to be proactive whoever gets in,” one participant said, underscoring the importance of strategic engagement with any future US administration.

With significant economic and geopolitical stakes in play, New Zealand’s business leaders are hoping for a US administration that can balance domestic priorities with global responsibilities – whoever the next president may be.

Though there is hope that a Harris administration could be more favourable to trade compared to a Trump-Vance ticket, business leaders emphasised that New Zealand needs to be proactive, regardless of the election outcome.

“It’s up to us to be proactive whoever gets in,” says Barfoot & Thompson managing director Peter Thompson.

With significant economic and geopolitical stakes in play, business leaders are hoping for a US administration that can balance domestic priorities with global responsibilities – whoever the next president turns out to be.

China and … the growth of diversification strategies

We will work hard to diversify out of China, but let’s acknowledge it’s easier said than done. CEO Despite concerns over China’s potential geopolitical moves, New Zealand businesses remain intertwined with the Chinese economy.

Prime Minister Christopher Luxon has made the case for growing New Zealand’s trade and investment opportunities offshore. That is the basis for the Government’s “China and…” approach, building the trade and economic relationship with China, but also developing new partnerships offshore, to build resilience and diversify opportunities for New Zealand businesses.

The survey results show that of those already engaged in business with China, 65% have either diversified or are planning to diversify into other markets to reduce risk. “We already have diversified market engagement, including China,” says Auckland Airport CEO, Carrie Hurihanganui. Companies are increasingly looking to regions beyond China.

OfficeMax managing director Kevin Obern notes: “Some diversification of supply is already under way – however still mostly in Asia,” while Mainfreight CEO Don Braid highlights his business’s efforts to diversify into the wider Asian region to build resilience.

“We have our own business within China, and seeing that grow is a priority. Likewise, we have diversified into the rest of the Asian region to assist our network intensity and access to other attractive country markets and opportunities.”

Similarly, the exploration of additional markets is seen as attractive. A professional director in the retail sector highlights: “We are now sourcing from India and Bangladesh in addition to China,” as part of their diversification strategy. Despite efforts to explore new markets, diversification is not without its challenges.

One CEO candidly admits: “We will work hard to diversify out of China, but let’s acknowledge it’s easier said than done.” China’s scale and growth opportunities remain unmatched, making it difficult for businesses to reduce their dependency on the country.

“China is where the growth opportunities exist,” says Cordis managing director Craig Bonnor, underscoring why businesses remain committed to the market, even as they explore alternatives.

Mood of the Boardroom: Mood of the Boardroom: Business leaders’ optimism hits highest level since 2016 (NZ Herald)

Senior business leaders’ optimism on the New Zealand economy has surged.

Respondents to the Herald’s 2024 Mood of the Boardroom survey rated their confidence in the New Zealand economy at 3.23/5 on a scale of 1-5, where 1 signifies “much less optimistic” and 5 represents “much more optimistic”.

This year’s score is a significant improvement from last year’s 1.82/5.

In fact, this is the highest score for optimism in the New Zealand economy since 2016, when the previous National-led Government was in power under the prime ministership of Sir Bill English (3.6/5).

There is broad consensus that the fall in interest rates should lead to a more favourable domestic business environment. However, many business leaders caution that the journey to full recovery is far from over.

“Survive to 2025 has become survive through 2025,” says Kirsten Patterson, chief executive of the Institute of Directors. “There are some green shoots showing but I am not sure the national and global economic environment is right to nurture those properly yet.”

Many of the country’s top professional directors echo this cautious optimism.

A retail sector director acknowledges the positive signs but remains wary: “There are definitely some green shoots but discretionary spending will continue to be constrained and unemployment will lift in the short-to-medium term.”

A similar sentiment comes from a tech sector director: “I see green shoots with the policies the National Government is starting to implement, but I still believe there is a long way to go to remedy some of the economic struggles and societal division that we are facing into.”

Despite the current economic difficulties, there is hope that things will soon improve.

Morrison CEO Paul Newfield is optimistic: “New Zealand is doing it tough at the moment, but we seem to be getting inflation under control, so hopefully that flows through to lower interest rates and more supportive economic conditions.”

Deloitte chair Thomas Pippos shares a similar outlook.

“The sense is that we have bottomed out and while we may bounce around the bottom over this next period, the expectation is that trading conditions will improve.”

CEO optimism in the global economy has also seen a boost, climbing to 3.06/5 from 2.23/5 in 2023. Though again, this is tempered by caution, as global uncertainties persist.

“The geopolitical and economic uncertainties globally mean we are not immune from further headwinds,” warns Dame Therese Walsh, chair of Air New Zealand and ASB.

A professional director shares this concern, citing major international factors: “It’s hard to feel comfortable when two of the biggest economies in the world — China and US — are (for differing reasons) continuing to be sluggish.”

As is typical in this survey, chief executives expressed more optimism about their own industries than they did about the broader New Zealand or global economy, with a weighted average score of 3.34/5.

This is a significant rise from last year’s 2.47/5, indicating that while broader economic concerns persist, many industries are seeing a potential pathway to growth.

Optimism varies across sectors

The real estate industry topped the list with an average score of 4.33/5, a substantial jump from last year’s 2.60/5.

Barfoot & Thompson managing director Peter Thompson explains, “Whilst we are positive with the outlook for sales, people are still struggling with paying their current high interest rates and it will take some time for this to come back to levels where they will be free to look at either upgrading or downgrading, without breaking their current mortgages.”

Healthcare and pharmaceuticals, as well as utilities, energy, and extraction, also showed strong confidence, each scoring 4.00 out of 5. The agriculture and agribusiness sector followed closely with a score of 3.86.

In the retail and consumer goods sector, optimism reached 3.33/5.

Foodstuffs North Island CEO Chris Quin is hopeful, saying, “We are optimistic about inflation continuing to fall — food was the first major category to show near or below zero price increases”.

Though he recognises that we are not out of the woods yet.

“Our industry is impacted by many issues, including ongoing global supply chain disruptions, elevated energy costs, and the potential for overseas economic shocks that put pressure on costs — orange juice is the latest.”

The construction and entertainment/leisure sectors recorded some of the lowest levels of confidence, both at 2.00/5. Tourism Holdings Limited CEO Grant Webster remarked: “Having been in several of our key trading countries in the past few weeks, it is evident NZ is more depressed than anywhere else.”

Education received the lowest optimism score of all, at just 1.80/5, reflecting ongoing challenges and uncertainties in the sector.

Domestic concerns

Executives were asked to assess their concerns on various domestic issues, and despite the improved optimism in the economy, several high-scoring challenges persist.

Energy-related concerns have surged to the forefront of business anxieties this year.

Energy price increases topped the list of domestic concerns, scoring 7.55/10 on a scale where 1=”no concern” and 10=”extremely concerned”, with executives troubled by the rapid escalation and volatility in energy costs. Closely following, with a score of 7.45/10, is the reliability of energy supply. The interconnectedness of these concerns underscores the pressure businesses face from the energy market.

Inflation and cost of living pressures remain significant, scoring 7.48/10.

Blair Turnbull, CEO of Tower, highlights the ongoing challenges: “Cost of living is an immediate concern and something we’re very focused on. We’re seeing continued strong retention as New Zealanders value their insurance and are prioritising premium payments. We’re helping customers with ways to lower premiums and improving business efficiencies to remain competitive. As inflation has begun to settle, we’ve already adjusted our pricing, and we expect to see pricing increases ease further toward the end of the year.”

Interest rate levels are also a pressing issue, scoring 7.14/10 and the Reserve Bank’s management of the Official Cash Rate (6.76/10).

An agribusiness chair noted, “Due to New Zealand debt levels, the economy is shrinking faster than expected and the Reserve Bank have been too slow to cut interest rates. The next year will see massive drops to stimulate the economy.”

Other notable domestic concerns include cyber threats (7.01/10), rising insurance costs (6.97/10); and climate change policies (6.72/10).

Paul Newfield, CEO of Morrison, offered a broader perspective on the factors holding New Zealand back: “In global terms, we benefit from a relatively open economy, low levels of corruption, and high levels of transparency.

“What’s really holding us back is lack of capital, short-term thinking, and not enough global ambition. That’s more on business leaders to solve than it is on politicians.”

Long-term thinking and collaboration needed

“Lack of long-term thinking and joint public-private sector engagement on options is impacting business confidence,” notes KiwiRail chief executive Peter Reidy.

The lack of societal cohesion and its impact on economic stability was also raised as another point of concern.

Bagrie Economics managing director and chief economist Cameron Bagrie warns of the “division across society,” describing it as “economically and socially corrosive”.

AUT Chancellor Rob Campbell adds that the “instability and uncertainty of social, economic, and environmental conditions dominate.”

Concerns directly related to Government and its policies have receded compared to last year.

The level and quality of Government spending, for instance, scored 6.60/10 this year, down from 8.17/10 in 2023. “The volume of public sector spend has reduced significantly as expected following the change in Government and as countries seek to balance accounts following the additional spend during Covid,” says Beca executive chair David Carter.

Foodstuffs’ Quin says he sees some promising signs with a new Government now in office:

“There’s a renewed focus on investing in critical infrastructure, a stronger emphasis on law and order (which our store teams know firsthand is much needed), and a more thoughtful approach to how public money is spent.

“One positive lesson from Covid was that New Zealanders would align and act as a team.

“Business needs to do this, speak up, and focus to play its part in the solution.”

Skills shortage easing, but challenges remain for NZ businesses

Finding suitably skilled staff remains a significant challenge, though the situation is showing signs of improvement. The Mood of the Boardroom survey asked executives how easy it has been to recruit a suitably skilled and qualified staff member.

On a scale of 1-5 where 1= “very hard” and 5= “very easy”, the average score was 3.37/5. Despite the relatively high score, responses varied depending on the sector and the specific roles being filled.

For some sectors, the recruitment landscape has seen marked improvements, largely because of recent redundancies in the market.

The head of an engineering consultancy observes “There are great people in the market because of the rightsizing that is happening across the economy. The challenge is that with the downturn in the infrastructure market, we are seeing more people looking to head overseas for the larger projects.”

Carrie Hurihanganui, CEO of Auckland Airport, agrees, noting that conditions have “improved considerably from last year, but still challenging to get some of the highly skilled roles we are looking for.”

In hospitality, Craig Bonnor from Cordis Auckland says “Things have improved from the same time last year”. Freightways director Mark Cairns echoes this sentiment: “Much better than last year.”

Paul Newfield, CEO of Morrison, says though New Zealand continues to produce great talent and attract investment, the small investment management ecosystem presents challenges. “We often need to look to Australia to recruit highly specialised roles. Ultimately that’s a consequence of New Zealand’s low retirement savings rates and small capital pools,” he explains.

Dame Therese Walsh, chair of Air New Zealand and ASB, highlights the ongoing difficulty in sourcing specific skill sets: “Certain cohorts of skilled labour such as engineers and data scientists still hard to come by. In other areas, key issues for attracting talent are culture and wages.”

The CEO of a major research firm says that it is hard to attract both technical/specialist staff as well as those for corporate roles. “We are getting a lot of applications, but usually lower quality than desirable. We are struggling to reconcile candidate pay and benefit expectations versus our assessment of their skills and qualifications.”

KiwiRail CEO Peter Reidy highlights a persistent issue in his industry, stating, “Technical rail expertise is a global issue, with New Zealand’s attractiveness reducing for offshore recruitment compared to Australia.”

Chris Quin, CEO of Foodstuffs North Island, believes the situation is improving, but underscores the need for New Zealand to remain an attractive destination for global talent.

“Access to skills and talent has gotten better. While New Zealand is increasingly open to talent we need to keep working on being an attractive option for people who have the skills we need and want to make New Zealand a home for them and their families. If we’re going to have more open immigration policies, we need to respect, value and welcome the people who choose to live and work here.”

Mood of the Boardroom: New Zealand needs visionary leaders to tackle ageing population and healthcare costs (NZ Herald)

With the country facing significant challenges both domestically and internationally, New Zealand, more than ever, needs leaders willing to take decisive action and implement big ideas, one of our most influential lawyers says.

Dentons New Zealand chairman and global vice-chairman Hayden Wilson, says to do this, the nation’s leaders must understand there are big differences between managing a business and running a Government.

“Governments are complex. Compared to business, you don’t have all the same levers to pull – and the lag time between pulling a lever and getting tangible progress is much longer.”

He argues simply applying a corporate mindset focused on short-term wins and quarterly goals isn’t sophisticated enough, on its own, to manage the complex challenges the country faces.

Truce on infrastructure

“Every person you speak to in the infrastructure space in New Zealand recognises that we have got to end the stop-starts and flip-flops on projects.”

He says there is a critical need for political leadership that thinks beyond election cycles.

“New Zealand has significant infrastructure demands over the next five, 10, 15 years and beyond.

“We’ve got an ageing population, increasing healthcare costs, and a changing global environment. We cannot just rely on the same old solutions.”

Wilson says the tendency of new Governments to scrap their predecessor’s projects is a waste of time, money, and planning effort, pointing to the Government’s decision to shelve Auckland Light Rail and the Three Waters reform when it came to power.

“The economy and business community would be better served if both parties took an approach of improving or adapting what’s already there, instead of throwing it all out and starting from scratch.”

Wilson suggests bipartisan agreement on infrastructure is not realistic, because political parties legitimately have different ideas. Instead, he suggests a “truce” on infrastructure.

“Parties are always going to have different ideas. But there needs to be some understanding that Governments should be allowed do the things they want, and once a project starts, it gets finished, no matter who’s in power.”

He references Bent Flyvbjerg’s How Big Things Get Done. Flyvbjerg is an expert on large-scale projects who advocates for “thinking slow, acting fast.”

Wilson explains: “We need to spend more time on planning and testing ideas before breaking ground. Once we start, we should be able to complete it efficiently and quickly”.

He says New Zealand, and others around the world, tend to do the opposite.

“We rush the planning phase because we know that, in political reality, once shovels are in the ground, projects rarely get stopped.

“This leads to poor planning, underestimating costs, and exposes us to risks like political changes or global events.”

Efficiency over cuts

Wilson also sees room for improvement in the Government’s approach to public sector spending.

He believes there has been too much emphasis on cost-cutting, and not enough on making the system more efficient.

“I don’t think you could find anyone who would say that there isn’t waste in the public sector and that it is delivering efficiency,” he says.

“But while the wholesale reduction in spending might be the fastest way to give the Government something it can point to and say it has done, it is perhaps not the best way to go about it.”

Instead, Wilson argues for a more strategic approach that balances the number and quality of public servants, the use of consultants, and the government’s ability to achieve its priorities.

“You can have two of those three things, but not all of them at once,” he explains. “If you want to reduce the size of the public sector while also cutting down on consultants, then you’re going to struggle to achieve all of the Government’s priorities because the capacity to do the work simply won’t be there.”

He suggests a more collaborative effort between the public and private sectors would be more effective in delivering on the Government’s goals.

“It’s about delivering value over the long term, not just making immediate savings. It may be a slower process, but it would yield better outcomes in the end.”

Dentons is a sponsor of the Herald’s Mood of the Boardroom project.