http://bit.ly/2YACfm3

At last night’s highly anticipated Deloitte Top 200 event, the winners of 11 award categories were unveiled.

The prestigious black-tie event recognises and honours outstanding performance among New Zealand’s largest companies and trading organisations. Held at Auckland’s Spark arena, there was a record turnout — with 1100 of New Zealand’s premier business leaders, politicians and media in attendance.

Mainfreight took out the top award, recognised as the Deloitte Digital/Marsh Company of the Year for its outstanding achievement over the past year and for being among New Zealand’s most globally successful businesses.

The logistics and transport company has been a frequent sight at the awards over the years. It was a finalist for Best Corporate Strategy and Most Improved Performance in 1996 and 2005, won awards for Best Growth Strategy in 2007 and 2012, and was previously awarded Company of the Year in 2011.

This year, the panel of high-profile judges — convened by NZME Head of Business Content Fran O’Sullivan — said Mainfreight was a deserving winner, recognising that it has reported one of the standout financial performances of the year, with strong growth in operating earnings in the international regions it operates in.

“These results demonstrate that Mainfreight is growing its market share in those large markets, underpinning growth in group profits for the year of 26 per cent and on total revenues of just under $3 billion,” said the judges.

Given Mainfreight’s long-running success, it is plain to see why managing director Don Braid was crowned Executive of the Decade. He has been a previous recipient of the coveted Executive of the Year award in both 2008 and 2011 — one of only two executives to have achieved this in the history of the Deloitte Top 200 awards.

The judges said Braid, who has been at the helm of Mainfreight for all of the past decade, is an outstanding leader with vision, drive and humility. He set Mainfreight on a course to expand internationally in the highly competitive global supply chain logistics business and has successfully delivered on that strategy with outstanding performance.

Outgoing Mercury head Fraser Whineray, who is about to begin a challenging new role as chief operating officer at Fonterra, was named this year’s Deloitte/ServiceNow Chief Executive Officer of the Year.

The judges said he has not only delivered record earnings for Mercury along with solid dividend growth, but also re-positioned the company around its 100 per cent renewable generation position while undertaking an active capital investment programme especially around wind generation.

The only award that is given without finalists — the NZ Herald Premium Visionary Leader — went to former Labour Cabinet Minister and Wellington Mayor Dame Fran Wilde. The judges say this prestigious award recognises Wilde’s ability to see opportunities and take on tough issues — and her passion and energy to make New Zealand a better place.

The judges say Wilde’s contribution to the country has long been underrated: “She does things that are worthwhile. She sees opportunities that are good for the country and the community and is prepared to invest time and effort to help out, paid or unpaid.”

After having been a finalist in the category last year, David Pilkington was named Hobson Leavy Executive Search Chairperson of the Year. He currently chairs the boards of Port of Tauranga, Douglas Pharmaceuticals and investment firm Rangatira.

The judges say he is an inclusive chair, facilitating an environment to get the best out of people, and was selected “due to his track record of success as a chair over a long period”.

Grant Ellis of Restaurant Brands — the company which operates the KFC, Carl’s Junior, Pizza Hut and Taco Bell brands in New Zealand — was awarded University of Auckland Business School Chief Financial Officer of the Year. The judges say Ellis, who has run the financials for over 20 years, has been a key part of the management team and helped drive its growth strategy. “The success of that has resulted in Restaurant Brands delivering top decile shareholder returns of over 30 per cent per annum for the past 10 years,” they say.

The Warehouse Group took out the OneRoof.co.nz Most Improved Performance award this year, impressing judges with its significant growth in revenue, profits and gross margin — and share price — in the 2019 financial year.

They say its performance is due to the successful execution of its business transformation programme in a changing and challenging retail environment.

Datacom was recognised with the 2degrees Best Growth Strategy award. The judges say the longevity and dexterity of the information technology services firm was recognition of its ability to thrive when competing with traditional global players — accumulating an enviable record of 21 years of continuous revenue growth.

Datacom were winners again in the Eagle Technology Young Executive of the Year category, with enterprise portfolio manager James David recognised for his huge vision, passion and outstanding leadership potential.

The judges say David “provides a great example — integrating and celebrating his Māori culture within the corporate world,” adding that he is very focused on bridging that cultural divide to change the country for the better.

Downer’s continued commitment to the Te Ara Whanake programme and its intent over the past five years to increase diversity throughout the company, saw it recognised with a win in the Diversity and Leadership category.

Air New Zealand took out the MinterEllisonRuddWatts Sustainable Business Leadership award. A new category in the awards this year, it recognises businesses working toward creation of long-term environmental, social and economic value.

The judges say while they acknowledge the airline’s environmental impact, they applaud it for introducing measures in areas where it can, and for having a strong impact in social and governance aspects of the category.

The Deloitte Top 200 Index consists of New Zealand’s largest entities ranked by revenue. These entities include publicly-listed companies, large unlisted entities, NZ subsidiaries and branches of overseas companies and the commercial operations of Māori entities. It also includes producer boards, co-operatives, local authority trading enterprises and state-owned enterprises.

The financial figures for the Top 200 as well as New Zealand’s Top 30 finance companies have been produced in full toward the back of this report — showing revenue, profitability, efficiency and more.

These numbers offer an insight into how the biggest companies in New Zealand operate and are accompanied by explanations and insight from the Herald’s team of business reporters.

The high-level story for the Top 200 this year is continued growth. Total revenues rose by 4.0 per cent compared to the 2018 figure. This increase also drove an increase in underlying earnings (EBITDA), which rose by 5.7 per cent. Total profits after tax were also up 6.3 per cent year-on-year.

Eighteen companies made their debut on the Top 200 Index this year. Most notable was Lotto NZ, which entered the Index at the highest rank (37th) with revenue of $1,113m.

Year-on-year asset growth for the Top 30 finance companies outpaced last year’s figures, up 4.0 per cent. Cumulative profits also increased by 8.3 per cent.

Despite a difficult year, ANZ continues to sit comfortably at the top spot with $159.0b in assets, outranking its closest competitor BNZ by $59.0b. There has been a reshuffle of rankings between the biggest banks. BNZ has overtaken Westpac to rank second this year, increasing total assets by 4.9 per cent.

http://bit.ly/2rtSt4l

New Zealand has an electricity system that is largely based on renewable energy. Because of our existing competitive advantage in wind and hydro power, many leaders in sustainable transportation predict hydrogen will only play a small role in New Zealand’s fleet.

A recent report by Z Energy shares a similar perspective, noting: “Z’s view is that hydrogen is more suitable for decarbonising high-utilisation, long-range use cases such as trucks, ferries, trains and buses, while battery electric will be the better choice for the shorter-range fleet.”

Adoption of electric vehicles (EVs) here is rapidly increasing — from 210 cars in 2013 to 10,000 in 2018. The benefits from EVs include lower emissions, quieter running, and the fact that they can act as a flexible storage solution for intermittent renewable energy.

And it is not just electric vehicles. The Global Battery Initiative, a World Economic Forum initiative, has called batteries a “backbone technology” in the transition from fossil fuels to a low-carbon future. Batteries — and particularly lithium-ion batteries — are powering anything from toys to cameras, e-scooters to e-bikes, trains and even electric vehicles.

But one of the major challenges faced by the industry is how to treat these batteries at the end of their useful life.

Further compounding this is the fact that New Zealand’s uptake of electric vehicles is heavily reliant on the introduction of second-hand vehicles. Cars are imported with semi-depleted batteries — they will reach the end of their useful life sooner than new cars.

This means the requirement to innovate to meet this challenge is especially front of mind for New Zealand — something that has been recognised by the Battery Industry Group (B.I.G), a cross-industry collaboration launched last week.

The group acknowledges the current “linear” system — extracting materials from the ground to make a battery, using the battery once and then putting the ‘waste’ battery into land fill — is not sustainable.

Made up of over 80 businesses — including a core delivery team of Vector, Eunomia Research & Consulting and WasteMINZ, with funding from Vector, EECA and the Motor Industry Association of New Zealand — the group will design solutions to reuse and recycle the large batteries found in electric vehicles or in stationary energy storage.

They note that a commercially sustainable model will require a shift across the entire system, and aim to propose a “circular” product stewardship scheme for end-of-use and end-of-life battery management to the Ministry for the Environment within the next 12 months. It will include recommendations on consistent safety guidance for the handling, storage and shipping of used large batteries.

Vector says the move acknowledges the important role businesses can play in not only front-footing the e-waste challenge, but also acts as a catalyst to accelerate New Zealand’s transition to a low-emission circular economy.

“Vector recognises that electrification of transport presents a significant opportunity to help

New Zealand achieve a zero-carbon future,” says Vector Group CEO, Simon Mackenzie.

“The research in the New Energy Futures Paper tells us that there will be between 500 and 1000 EV batteries coming to the end of their lives by 2020, potentially rising to 17,000 by 2025 and a staggering 84,000 by 2030.”

He says that while batteries will be key to powering New Zealand’s new energy future, they contain valuable materials that come at an environmental and social cost. It’s clear that we must work collaboratively with others to ensure we have a proactive, robust plan in place to make the most of battery capacity, as well as mitigating any risks from their disposal.

http://bit.ly/2LBbKYC

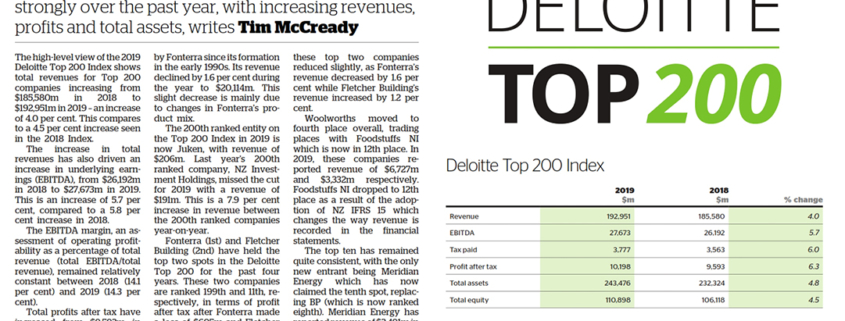

The high-level view of the 2019 Deloitte Top 200 Index shows total revenues for Top 200 companies increasing from $185,580m in 2018 to $192,951m in 2019 – an increase of 4.0 per cent. This compares to a 4.5 per cent increase seen in the 2018 Index.

The increase in total revenues has also driven an increase in underlying earnings (EBITDA), from $26,192m in 2018 to $27,673m in 2019. This is an increase of 5.7 per cent, compared to a 5.8 per cent increase in 2018.

The EBITDA margin, an assessment of operating profitability as a percentage of total revenue (total EBITDA/total revenue), remained relatively constant between 2018 (14.1 per cent) and 2019 (14.3 per cent).

Total profits after tax have increased from $9,593m in 2018 to $10,198m in 2019. This is a 6.3 per cent increase year-on-year compared to a 7.2 per cent increase in 2018.

Net profit margin (profit after tax/total revenue) stayed relatively constant between 2018 (5.2 per cent) and 2019 (5.3 per cent).

Total Assets have increased from $232,324m in 2018 to $243,476 in 2019, which is a 4.8 per cent increase and compares to a 6.2 per cent increase in 2018.

The number one spot in the Top 200 Index has been held by Fonterra since its formation in the early 1990s. Its revenue declined by 1.6 per cent during the year to $20,114m. This slight decrease is mainly due to changes in Fonterra’s product mix.

The 200th ranked entity on the Top 200 Index in 2019 is now Juken, with revenue of $206m. Last year’s 200th ranked company, NZ Investment Holdings, missed the cut for 2019 with a revenue of $191m. This is a 7.9 per cent increase in revenue between the 200th ranked companies year-on-year.

Fonterra (1st) and Fletcher Building (2nd) have held the top two spots in the Deloitte Top 200 for the past four years. These two companies are ranked 199th and 11th, respectively, in terms of profit after tax after Fonterra made a loss of $605m and Fletcher Building has made a profit of $259m.

Fonterra’s losses have largely been a result of asset write-downs of $826m, mainly on its offshore businesses. The write-downs include a $203m impairment of its China Farms investment and $237m on its New Zealand foods service business.

Fletcher Building returned to a profit due to the successful execution of the first year of its five-year strategy aimed to refocus and grow the business.

The revenue gap between these top two companies reduced slightly, as Fonterra’s revenue decreased by 1.6 per cent while Fletcher Building’s revenue increased by 1.2 per cent.

Woolworths moved to fourth place overall, trading places with Foodstuffs NI which is now in 12th place. In 2019, these companies reported revenue of $6,727m and $3,332m respectively. Foodstuffs NI dropped to 12th place as a result of the adoption of NZ IFRS 15 which changes the way revenue is recorded in the financial statements.

The top ten has remained quite consistent, with the only new entrant being Meridian Energy which has now claimed the tenth spot, replacing BP (which is now ranked eighth). Meridian Energy has reported revenue of $3,491m in the current year while BP has reported revenue of $3,699m. The rise in Meridian energy’s revenue is primarily from strong hydro conditions and higher wholesale market prices.

The overall increase in revenue this year has been reflected in the Government’s tax take from the companies that comprise the Top 200. Tax paid increased 6.0 per cent on last year’s figure, from $3,563m to $3,777m – contributing to the coalition government’s bumper surplus.

http://bit.ly/2Pr0A9L

The Air New Zealand executive team identified “sustainability in the bloodstream” this year as a long-term organisation-wide strategic pillar.

The airline says it believes its success is inextricably linked to the success of New Zealand, reflected in its company purpose statement: “Supercharge New Zealand’s success — socially, environmentally and economically.”

“This means tackling highly visible challenges such as reducing our plastic usage, but also facing into climate change (our most material sustainability challenge), supporting local communities, helping Kiwi businesses take their products to the world, and being a diverse and inclusive employer,” says Air New Zealand’s Head of Sustainability Lisa Daniell.

“Sustainability is an integral part of who we are and what we do, so much so that Sustainability in our Bloodstream has recently become one of seven long-term organisation-wide strategic pillars at Air New Zealand,” she says.

The Deloitte Top 200 judges commend the airline’s efforts in sustainability in an industry that contributes between two and four per cent of global emissions, and the transparency with which it reports on it through its sustainability report, released each year prominently alongside the more conventional financial reports.

The MinterEllisonRuddWatts Sustainable Business Leadership award is new to the Deloitte Top 200 Awards this year, recognising businesses that are working toward creation of long-term environmental, social and economic value.

The judging criteria considers governance, leadership and accountability, long-term perspective and purpose, explicit integration of environment, social and governance considerations, along with investments, programmes and projects to support sustainable development.

“Air New Zealand is showing strong leadership in diversity and inclusion as well as other social and governance aspects of this category,” says Deloitte Top 200 judge Cathy Quinn.

While the judges acknowledge the airline’s environmental impact, they applaud it for introducing measures in areas where it can and having a strong impact in social and governance aspects of this category.

“Governance and strategic management are advanced, with systems in place, targets set and being measured with both good and bad news reported, covering a comprehensive range of sustainability issues. There is a sense that there is a strong focus on solutions,” says Quinn.

The airline has improved its aviation fuel efficiency by more than 20 per cent over the past decade, through a combination of more fuel-efficient aircraft and more efficient flight operations.

Air New Zealand’s Airbus neo aircraft — with new generation engines, fuel efficient wingtip devices and more seats — are expected to deliver fuel savings of at least 15 per cent compared with the aircraft they are replacing. Other emission-reduction initiatives include implementing more efficient departure climb profiles and approach-path efficiencies.

Air New Zealand has moved to use electricity to power aircraft while at the gate whenever available, shifting away from consuming jet fuel and generating carbon dioxide emissions. It is also removing unnecessary weight from its domestic jet aircraft such as carrying less portable water on each flight and has removed or replaced nearly 55 million plastic items with lower-impact alternatives.

“The scale of our network and fleet means that any savings we make are substantial, and if we think about the influence we can have across our 4500 suppliers, or the likes of the Climate Leaders Coalition in New Zealand, that’s also really material,” says Daniell.

Air New Zealand’s sustainability report acknowledges that it emits around 3.5 million tonnes of carbon dioxide annually — making it one of New Zealand’s biggest carbon emitters.

The airline has been encouraging passengers to offset their emissions through its FlyNeutral programme. Over the past year, retail customers have partially or fully offset more than 183,600 journeys — up 40 per cent since the previous year. It has also seen a rise in the number of corporate and government customers joining the programme.

But Air New Zealand acknowledges further improvements will become tougher, and the industry now needs ‘to grow in a different way’.

It says: “While we are delivering such benefits and working to minimise our carbon emissions, until aviation biofuels are readily available in New Zealand or there are significant technology breakthroughs such as electric aircraft, we are unlikely to deliver further significant carbon emissions reductions through our own operations.”

Air New Zealand has joined with Z Energy, Refining NZ, Scion and Auckland International Airport to investigate how to transition to biofuel, and whether a biofuel plant in New Zealand could work, but the sustainability report notes that: “the capital investment would be significant and it has not been achieved anywhere in the world without substantial government support to establish production and thereafter ensure fuel pricing remains economically viable.”

It is also working with aircraft manufacturers to explore new propulsion technologies such as hybrid electric aircraft. It has partnered with Zephyr Airworks — the operator of Cora, the world’s first autonomous air taxi.

In his introductory video, incoming chief executive Greg Foran suggests the airline will continue to lead in sustainability.

“My vision for Air New Zealand would be to make it something that other airlines aspire to be,” he says.

“We need to be taking some positive steps around sustainability. There are a number of things that fit into sustainability — from carbon footprints driven by CO2 emissions, to social responsibility around sustainability.

“I think it is vitally important that we lead, not just in New Zealand, but actually around the world in terms of what we can accomplish.”

Finalist: Z Energy

Z Energy says it stands for “an environmentally sustainable New Zealand that is an example to the rest of the world and an inspiration to Kiwis.”

Chief executive Mike Bennetts says ultimately for Z, sustainability means balancing the needs of its people and customers now, with those of its people and customers of tomorrow.

“It means not taking more than we need now, so that those generations coming after us have enough. We do that across the three legs of our sustainability stool — economic, social and environmental,” he says.

Z says it will move from being a part of the climate change problem to the heart of the solution: “We will be bold and provide leadership and a range of solutions to enable our customers, stakeholders and communities to join on the journey to a lower carbon future.”

The Deloitte Top 200 judges recognise Z for leadership on climate when it could have been obstructive.

They also note Z Energy’s excellent annual report: “It is readable, with key metrics throughout, integrated with business strategy,” says Cathy Quinn. “It is an integrated report in its true sense, including both good and bad news and truly engaging its stakeholders.”

Bennetts says Z is focusing on two key things: “maximising our impact on intervening in climate change, and ensuring we do what we said we would in terms of cleaning up our own back yard.”

He explains that means delivering on its commitment to reduce its operational emissions by 30 per cent from a 2017 baseline, with the balance offset in permanent New Zealand forestry — a mix of natives and exotics.

“We have the opportunity to be right at the centre of the transport fuels solution but that will mean nothing if our responses lack integrity,” he says. “We are up for the difficult conversations on how we intervene in climate change that provides harmony across environmental, social and economic sustainability.”

Bennetts acknowledges the company’s big issue is the products it sells, not what it does. But he says that is exactly why Z can have the biggest impact.

“Our intent is to lead and facilitate the much-needed transition to lower carbon transport fuels than default to being a barrier to change,” he says. “The technology exists for lower carbon alternatives like biofuel and hydrogen, but our current challenge is finding a way to make that economically sustainable for our customers given the environmental and social Sustainability in the bloodstream sustainability is obvious enough.”

Bennetts says capital and innovation will come easily when the economics are better balanced, “especially when we price in the reality of social and environmental externalities.”

Z has been investing in alternative, cleaner fuels and alternative mobility technologies, including nearly $30 million in building New Zealand’s first commercial scale biodiesel plant, turning tallow — a by-product of the agricultural industry — into high quality biodiesel. It has also recognised electricity will be part of a clean energy future, investing a majority stake in Wellington-based retail electricity supplier Flick Electric.

At the time, Bennetts said “this is another step towards the long-term sustainability of Z, and the role we play in a lower carbon transport future.”

Z was a founding member of the Climate Leaders Coalition, launched last year to promote business leadership and collective action on the issue of climate change. Bennetts is the convenor of the Coalition, which aims to “help New Zealand transition to a low emissions economy and, in doing so, create a positive future for New Zealanders, business, and the economy.”

Finalist: Mercury

Mercury says sustainability is about delivering on its mission of energy freedom for New Zealand. “It’s about NZ being stronger economically and more sustainable through better use of homegrown, renewable talent.”

The electricity generator-retailer says being sustainable is an essential element of the way it operates: “We consider long-term sustainability across all the areas that matter most for us using our pillars — customer, partnerships, kaitiakitanga, people and commercial. This framework means we assess value and make decisions in an integrated way that includes consideration of commercial, social and environmental factors.”

The Deloitte Top 200 judges say that Mercury is in itself a sustainability solution — its contribution to New Zealand’s zero-carbon goals are significant.

“It has a clear strategy on environmental sustainability and has been proactive in social issues and places a key focus on its relationship with Māori,” says Cathy Quinn.

Mercury’s energy generation comes from 100 per cent renewable sources. The move away from thermal generation has helped the energy company decrease total emissions by 36 per cent since 2015.

This year, it committed to the construction of a new $256m wind farm at Turitea, east of Palmerston North — and recently announced it will pour another $208m to complete the farm at its full scale.

This makes Mercury the only New Zealand energy company with what it describes as “the awesome foursome” of renewable energy in its portfolio; along with the wind farm it has nine hydro stations on the Waikato River, five geothermal stations throughout the central North Island and a solar farm.

“Key initiatives aligned with our strategy have not only lowered Mercury’s carbon footprint, but they have been instrumental in materially reducing the nation’s carbon footprint,” says Mercury.

“We refer here to the transformation of the energy sector that was a consequence of the building, by Mercury and others, of significant geothermal generation capacity in the decade from 2003. Mercury’s geothermal stations include stations run as innovative joint venture partnerships with Māori enterprises.”

Mercury has been climate positive since 2017, with its carbon units exceeding the level of its emissions. It has achieved this through participation in the New Zealand emissions trading scheme, the careful measurement of its GHG emissions, and long-term partnerships with forest owners.

Natural resources and climate change are key focus areas for Mercury, it aspires to be recognised as a leader in the ultra-long-term management of both physical and natural assets by 2030.

For the last two years, Mercury has submitted information to the CDP (formerly the carbon disclosure project). The CDP runs the global disclosure system that enables organisations and government to measure and manage their environmental impacts. Mercury has been rated among New Zealand’s top ten companies — and the only energy company — that made a submission.

Chief executive Fraser Whineray has been a long-time advocate of electric vehicles (EVs). He says with New Zealand generating more than 80 per cent of electrity from renewable sources it is logical to take advantage of that. “It’s another step on what will be a long journey, but it’s one that New Zealand will be in the box seat for with its renewable electricity system,” says Whineray.

Mercury is encouraging New Zealanders to lower their own carbon footprint through the opportunity electric transport provides. It has done this through initiatives including promoting e-bikes and introducing Mercury Drive — an electric vehicle subscription service that launched a pilot this year and was heavily over-subscribed.

It has also reduced its emissions since 2016 by converting over 74 per cent of its fleet to electric vehicles or plug-in hybrid electric vehicles.

http://bit.ly/2LBNAgk

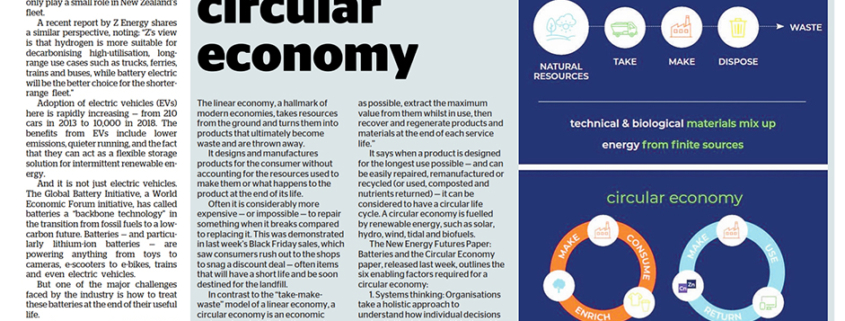

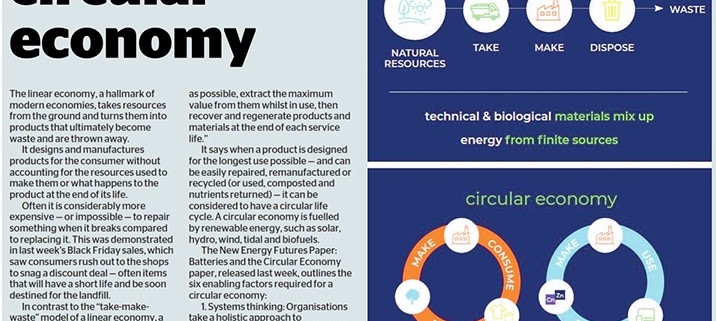

The linear economy, a hallmark of modern economies, takes resources from the ground and turns them into products that ultimately become waste and are thrown away.

It designs and manufactures products for the consumer without accounting for the resources used to make them or what happens to the product at the end of its life.

Often it is considerably more expensive — or impossible — to repair something when it breaks compared to replacing it. This was demonstrated in last week’s Black Friday sales, which saw consumers rush out to the shops to snag a discount deal — often items that will have a short life and be soon destined for the landfill.

In contrast to the “take-make-waste” model of a linear economy, a circular economy is an economic system aimed at eliminating waste and the continual use of resources and is designed to benefit businesses, society, and the environment.

It aims to gradually decouple growth from the consumption of finite resources and is increasingly seen as the driver to help reach the UN’s Sustainable Development Goals.

The New Zealand Government has identified the circular economy approach as an important principle for addressing resource and waste issues for the country’s future.

The Ministry for the Environment defines it as “an alternative to the traditional linear economy in which we keep resources in use for as long as possible, extract the maximum value from them whilst in use, then recover and regenerate products and materials at the end of each service life.”

It says when a product is designed for the longest use possible — and can be easily repaired, remanufactured or recycled (or used, composted and nutrients returned) — it can be considered to have a circular life cycle. A circular economy is fuelled by renewable energy, such as solar, hydro, wind, tidal and biofuels.

The New Energy Futures Paper: Batteries and the Circular Economy paper, released last week, outlines the six enabling factors required for a circular economy:

1. Systems thinking: Organisations take a holistic approach to understand how individual decisions and activities interact within the wider systems they are a part of (e.g. material, operational, financial, social and ecosystems).

2. Innovation: Organisations continually innovate to create value by enabling the sustainable management of resources through the design of processes, products/services and business models.

3. Collaboration: Organisations collaborate internally and externally through formal and/or informal arrangements to create mutual value.

4. Value optimisation (retaining value): Keeping products, components and materials at their highest value and utility at all times.

5. Transparency (open communication): Organisations are transparent about decisions and activities that affect their ability to transition to a more circular and sustainable mode of operation and are willing to communicate these in a clear, accurate, timely, honest and complete manner.

6. Stewardship: Organisations manage the direct and indirect impacts of their decisions and activities within the wider systems they are part of. This can include product stewardship or Extended Producer Responsibility (EPR), where businesses take back their products to refurbish and resell.

http://bit.ly/2YEWMpP

David Pilkington describes his style as chair as having a focus on ensuring the board and management have a well understood joint strategy for the business, working together to develop the capability to achieve targets.

“This requires full engagement from the board which I encourage, and an open and frank relationship with the CEO and senior management team, with the right balance between challenge and support,” he says.

Pilkington — this year’s Hobson Leavy Executive Search Chairperson of the Year — is chair of the Port of Tauranga, Douglas Pharmaceuticals and investment firm Rangatira.

Until the end of November, he was also chair of Northport but has stepped down in line with a two-yearly rotational policy in place with its 50 per cent partner Marsden Maritime Holdings.

“Every entity he chairs has performed financially and grown consistently during his tenure,” says Deloitte Top 200 judge Cathy Quinn. “He is an inclusive chair and facilitates an environment to get the best out of people, and has been selected as the winner due to his track record of success as a chair over a long period.”

The judges add that he has developed chief executive talent and built constructive relationships with them — allowing them to do their job but also be guided by him.

Pilkington says his highlight over the last year has been overseeing the Port of Tauranga’s group net profit after tax (NPAT) exceed the $100 million milestone for the first time, as well as making big strides in its focus on sustainability having gained certification of its carbon emissions.

“The Port has set a short-term target of five per cent reduction in its Scope 1 emissions per cargo tonne and is targeting net zero emission by 2050,” he says.

The Port of Tauranga this year has seen exports and imports increase, handling an impressive 37 per cent of all containers in New Zealand and 30 per cent of the country’s cargo.

Despite the Port having a 6 per cent slip in profit after tax for the first quarter of the 2020 financial year, due in part to lower long volumes which dipped 5.2 per cent, it advised shareholders its full year guidance should see earnings between $96m and $101m — the same as the guidance provided last year.

“The Port of Tauranga’s success comes as a result of a co-ordinated investment strategy to become ‘big ship capable’ and at the same time entering into long-term agreements with its major cargo owners to provide services and support to commit to Tauranga as the major export port,” says Pilkington.

He says given the constraints and difficulties faced by the Ports of Auckland, Tauranga — and to some extent Northport — are able to provide an efficient and alternative gateway for the upper North Island.

“Port of Tauranga is ideally placed in a geographic sense to continue to grow,” he says.

“A recent study by an international consultant specialising in port operations identified that with further investment it would be possible to increase container handling capability to well in excess of the Port of Tauranga and Ports of Auckland’s current combined container volumes.”

Pilkington was also commended by the judges for being influential in his work with Douglas Pharmaceuticals.

As chair of the privately-owned company, Pilkington has worked with management following the passing of founder Sir Graeme Douglas two years ago.

“Graeme’s son Jeff has successfully taken up the reins and has increased the focus on the company’s new development pipeline — this is an exciting time for the business,” he says.

He has also been chair of diversified investment firm Rangatira since 2013.

Rangatira — whose investments include Polynesian Spa, Rainbow’s End Theme Park, and Mrs Higgins — operates a flexible investment management strategy that allows it to work alongside owners to maintain what it is that has made the company successful.

Pilkington says the investment firm has just passed its 82nd year since its establishment in 1937.

“Its success has been based on equity partnerships with successful SME owner operators who have reached a point with their businesses where they are either facing inter-generational succession or require new capital for growth,” he says.

“Unlike the traditional private equity company model with short-to-medium investment horizons, Rangatira is prepared to take a long-term view and is flexible depending on the founders’ needs going forward.

“We see our equity investments as true partnerships.”

Finalist: Graeme Milne, Synlait

Graeme Milne says he is driven by the opportunity to grow New Zealand enterprise and develop and create value-added activities and jobs. “Satisfying, purposeful jobs. That’s the key thing for me,” he says.

The judges say Milne has been brave in taking on roles as chair of companies at an early stage and seeing them transform to become very successful.

“He is quick to give credit to others but his strategic thinking and calm manner under pressure have been key factors in the success of companies he has been involved with,” says judge Cathy Quinn.

Milne has an impressive resume. He is chair of Synlait Milk, nutrient and fertiliser company TerraCare, forestry services firm PF Olsen, Rimanui Farms and plastics company Pro Form. He describes his style as supportive of the executive and consultative with the directors, seeking consensus and ensuring the focus is on strategy. “Not wanting to necessarily be the spokesperson — that is more for the CEO,” Milne adds.

Milne has been chair of Synlait since 2004 — initially at Synlait Ltd, the predecessor of Synlait Milk.

He indicated at last year’s AGM he wouldn’t stand again, saying it had been great to be part of an exciting company for such a long stint.

As chair at Synlait he has presided over rapid progress. He says the fact he has always been keen on the land and has a background as a sheep and beef farmer and in the dairy industry has helped in terms of knowing what works and what doesn’t.

Since listing on the NZX in 2013, Synlait has grown at 15-20 per cent a year. Milne attributes this exceptional growth to it having been built into Synlait’s culture to always look strategically for the next step.

“If anything, we’re probably stepping a bit faster than we can digest at times. That’s what we have to be careful of — there are always more ideas than the ability to execute on them.”

He says Synlait is a talent magnet, and headed for 1000 staff: “You have to be careful you don’t disappoint really capable people when they get into the company, if systems have to catch up and all the rest of it. The key is not to trip over.”

This year Synlait acquired South Island-based cheese manufacturer Talbot Forest Cheese, and recently announced its intention to buy Christchurch-based dairy company Dairyworks for $112 million.

But Milne says his highlight over the past year has been getting Synlait’s Pokeno processing plant commissioned and running. The move into Waikato away from its Canterbury base has seen it sign up its first farmers in the region.

“To establish a completely greenfield operation, and have North Island farmers have faith in us and shift to us from their previous supplier — there is still a way to go, but it is running very smoothly,” he says.

“Synlait is a real growth story — startup from an idea,” he says. “And I don’t really want to leave, but you can’t stay forever.”

Finalist: Pip Dunphy, Transpower

Pip Dunphy is a highly regarded professional director, having worked across a broad range of companies as a non-executive director over the past 12 years.

Deloitte Top 200 judge Cathy Quinn says Dunphy is a strong, courageous chair “who has been willing to stand her ground in tough circumstances to hold to what she believes is right.”

Dunphy says it is important the boards she leads operate as one team with management: “That is a philosophical preference for me.”

Her current governance roles include chair of Transpower, Abano Healthcare, First Gas, and director of the Fonterra Shareholders’ Fund.

The judges say Dunphy brings strong finance skills to all her governance roles — derived from her experience working in capital markets, banking, finance and investment management. She has had executive positions in Goldman Sachs JBWere, BNZ and Bankers Trust.

Dunphy says she encourages any director starting off to gain experience across a diverse range of industries: “I’ve been fortunate to have the range of opportunities I have had.

“Beyond that, I think the selection is really about the people you are working with. Initially it was the opportunity to work with people I respected as chairs and learn from them.”

State-owned transmission company Transpower, a natural monopoly, is regulated by the Commerce Commission and Electricity Authority. Dunphy says this provides a very interesting perspective. “You always have to be mindful in that environment of your regulators and your obligations to your customers. In terms of the position in the industry that Transpower holds, that is always front of mind.”

She was previous chair of state-owned enterprise Solid Energy, resigning in 2015, disagreeing with then-Finance Minister Bill English over whether the company, debt-laden from unrealised expansion plans, was salvageable. Following her departure it went on to being placed into voluntary administration.

She says Solid Energy provides the best illustration of the challenges of being an SOE director. “The Solid Energy experience was, to me, a question around judgement and decision making around going concern, which I feel very strongly is a director’s prerogative,” she says.

“It is really important for the shareholder of an SOE to respect the role of directors, and similarly for directors to be understanding of the shareholders,” she says.

Dunphy says in chairing her diverse portfolio she has had a number of highlights over the past year:

“For Transpower it was the finalisation of our regulatory allowances and quality standards for our Individual Price Path (IPP) for the 2020-2025 period with relatively modest adjustments by the Commerce Commission in the process; for First Gas it was the highly commendable execution of the repairs to the Maui pipeline to repair damage; and for Abano it was finalising the expression of interest process which resulted in a take-over offer by way of a scheme of arrangement.”