New shifts in sustainability trends continue at pace

New shifts in sustainability trends continue at pace

The final leaders’ communique from the G7 states: “2021 should be a turning point for our planet as we commit to a green transition”.

Many of the sustainability trends in business that were on the rise last year are continuing at pace.

The pandemic highlighted the interconnectedness between social, environmental and economic challenges. It reinforced that an approach, centred around strong environmental, social and governance (ESG) principles is important for a sustainable future and that companies with strong track records in these areas tend to do well in the long-term.

But there are distinct new shifts in sustainability that have emerged over the past year that will shape the agenda and have a major impact on business in the months and years ahead.

Increased data and disclosure to counter greenwashing

The demand from consumers for sustainable business practices brings with it a growing concern that greenwashing is being used to obfuscate environmental credentials.

Recent audits have shown this concern has substance. A study of 12 of the biggest British and European fashion brands found 60 per cent of environmental claims could be classed as “unsubstantiated” and “misleading”. In another study, a sweep of company websites across a range of sectors by the European Commission found that green claims in 42 per cent of cases were exaggerated, false or deceptive under EU rules.

There is a growing expectation that companies will substantiate claims made.

Going a step further, some consumers and investors are expecting companies to disclose a plan for how their business model will be compatible with a net-zero economy — including detail on how that plan is incorporated into a long-term strategy that it is reviewed by the board of directors.

Earlier this month, former US Vice-President Al Gore told the Bloomberg Green Summit: “we must be vigilant about the rising threat of greenwashing or risk derailing the hard-won progress” that has been made in recognising the climate crisis.

He also noted that sustainable investing has “entered the mainstream,” providing even more openings for potential greenwashing.

Gore is right — sustainable investment opportunities have begun flooding the market to meet demand from investors looking to make decisions aligned with their ESG values. Of the S&P 500, about 90 per cent of companies publish sustainability reports, yet only 16 per cent have any reference to ESG factors in their filings — clearly demonstrating the gap between what companies voluntarily publish and regulatory disclosure.

To counter this, a broad range of requirements are being swept in to standardise the current patchwork of regulations and disclosure frameworks.

In March, Wall Street’s top regulator the Securities and Exchange Commission (SEC), announced the creation of a Climate and ESG task force to develop initiatives that will “proactively identify ESG-related misconduct”.

“Climate risks and sustainability are critical issues for the investing public and our capital markets,” said SEC acting Chair Allison Lee.

The task force will use sophisticated data analysis to identify potential violations, and evaluate and pursue tips, referrals and whistle-blower complaints on ESG-related issues.

The CFA Institute, a global association of investment professionals, is developing ESG standards for investment funds and other products, aiming to “provide greater product transparency and comparability for investors by enabling asset managers to clearly communicate the ESG-related features of their investment products”. Draft guidance was released earlier this year that the CFA Institute hopes will be adopted by fund companies around the world.

Global action to build back better and provide a green alternative to Belt and Road

One of the most dramatic turnarounds from the Trump administration has been the pace at which President Biden has thrown the weight of the United States behind global efforts to address global ESG issues.

Many of the Biden administration’s key people have been brought in with a strong environmental focus. Alongside this, the US quickly re-joined the Paris Climate Agreement, a new White House office of climate policy was established, and former Secretary of State John Kerry was appointed as international envoy on climate change.

In May, the White House issued an Executive Order that lays out a whole-of-government approach to addressing climate risks.

The recent Group of Seven (G7) meeting in Cornwall, United Kingdom, saw leaders announce the “Build Back Better World” (B3W) partnership. B3W is a “climate-friendly” initiative to mobilise private capital to help narrow the US$40+ trillion infrastructure need in the developing world which has been exacerbated by the Covid-19 pandemic — and has been described by some as a green counter to China’s Belt and Road Initiative.

Alongside this, the G7 leaders put forward ambitious targets for climate action. One of these targets saw a commitment to long-term strategies to net-zero greenhouse emissions by 2050 as soon as possible, “making utmost efforts to do so by COP26 (the UN Climate Change Conference COP26 in Glasgow in November).”

They also committed to set net-zero targets for energy generation in the 2030s and end direct government support for new thermal coal generation capacity without co-located carbon capture and storage technologies by the end of this year.

All other inefficient fossil fuel subsidies will be phased out by 2025. There was also a commitment made to stop direct funding for coal-fired power stations in OECD nations by the end of this year.

Other commitments made during the G7 that will impact the sustainable finance sector include the mandating of climate disclosures; a commitment to “intensify efforts in enhancing the offer of more sustainable transport modes” including encouraging the phase-out of traditional passenger vehicles in favour of electric vehicles by 2040; and a goal to jointly mobilise US$100 billion per year from public and private sources through to 2025 for developing countries.

These sweeping changes will have wide-ranging implications for governments, business, innovation, and financing.

The final leaders’ communiqué from the G7 states:

“2021 should be a turning point for our planet as we commit to a green transition” and accelerate efforts to cut greenhouse gas emissions, and “we acknowledge our duty to safeguard the planet for future generations” — although some have criticised the G7 for not being more ambitious in financial commitments to developing countries and for not being detailed in the plans to promote a green industrial revolution.

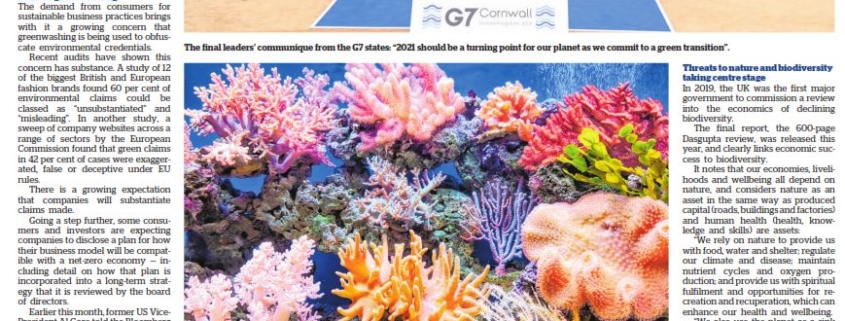

Threats to nature and biodiversity taking centre stage

In 2019, the UK was the first major government to commission a review into the economics of declining biodiversity.

The final report, the 600-page Dasgupta review, was released this year, and clearly links economic success to biodiversity.

It notes that our economies, livelihoods and wellbeing all depend on nature, and considers nature as an asset in the same way as produced capital (roads, buildings and factories) and human health (health, knowledge and skills) are assets:

“We rely on nature to provide us with food, water and shelter; regulate our climate and disease; maintain nutrient cycles and oxygen production; and provide us with spiritual fulfilment and opportunities for recreation and recuperation, which can enhance our health and wellbeing.

“We also use the planet as a sink for our waste products, such as carbon dioxide, plastics and other forms of waste, including pollution.”

The World Economic Forum estimates that $US44 trillion of economic value generation representing more than half of world GDP is moderately or highly dependent on nature. Yet the world’s biodiversity is declining faster than it has at any other time in human history, with the current rate of extinction tens to hundreds of times higher than the average over the past 10 million years — and accelerating.

We can expect to hear more about this and see it impact business decision making. The UK government has published an amendment to its Environmental Bill, requiring new “nationally significant” infrastructure projects — including for transport and energy — to provide a net gain in biodiversity and habitats for wildlife.

Protecting and enhancing nature will need concerted, coordinated action and will be major topics at this year’s upcoming COP15 (UN convention on biological diversity) in China and COP26 (UN climate change conference) in Glasgow.

“This year is critical in determining whether we can stop and reverse the concerning trend of fast-declining biodiversity,” says UK Prime Minister Boris Johnson.

“As co-host of COP26 and president of this year’s G7, we are going to make sure the natural world stays right at the top of the global agenda,” he said. “And we will be leading by example here at home as we build back greener from the pandemic.”