“The sense is that we have bottomed out and while we may bounce around the bottom over this next period, the expectation is that trading conditions will improve.”

CEO optimism in the global economy has also seen a boost, climbing to 3.06/5 from 2.23/5 in 2023. Though again, this is tempered by caution, as global uncertainties persist.

“The geopolitical and economic uncertainties globally mean we are not immune from further headwinds,” warns Dame Therese Walsh, chair of Air New Zealand and ASB.

A professional director shares this concern, citing major international factors: “It’s hard to feel comfortable when two of the biggest economies in the world — China and US — are (for differing reasons) continuing to be sluggish.”

As is typical in this survey, chief executives expressed more optimism about their own industries than they did about the broader New Zealand or global economy, with a weighted average score of 3.34/5.

This is a significant rise from last year’s 2.47/5, indicating that while broader economic concerns persist, many industries are seeing a potential pathway to growth.

Optimism varies across sectors

The real estate industry topped the list with an average score of 4.33/5, a substantial jump from last year’s 2.60/5.

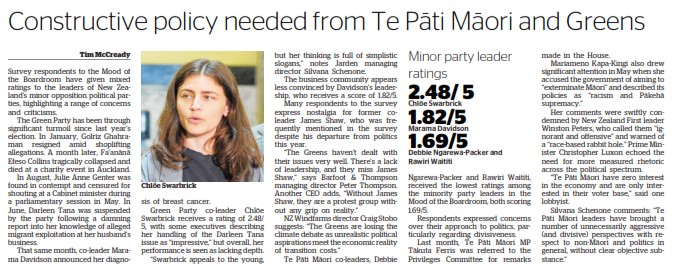

Barfoot & Thompson managing director Peter Thompson explains, “Whilst we are positive with the outlook for sales, people are still struggling with paying their current high interest rates and it will take some time for this to come back to levels where they will be free to look at either upgrading or downgrading, without breaking their current mortgages.”

Healthcare and pharmaceuticals, as well as utilities, energy, and extraction, also showed strong confidence, each scoring 4.00 out of 5. The agriculture and agribusiness sector followed closely with a score of 3.86.

In the retail and consumer goods sector, optimism reached 3.33/5.

Foodstuffs North Island CEO Chris Quin is hopeful, saying, “We are optimistic about inflation continuing to fall — food was the first major category to show near or below zero price increases”.

Though he recognises that we are not out of the woods yet.

“Our industry is impacted by many issues, including ongoing global supply chain disruptions, elevated energy costs, and the potential for overseas economic shocks that put pressure on costs — orange juice is the latest.”

The construction and entertainment/leisure sectors recorded some of the lowest levels of confidence, both at 2.00/5. Tourism Holdings Limited CEO Grant Webster remarked: “Having been in several of our key trading countries in the past few weeks, it is evident NZ is more depressed than anywhere else.”

Education received the lowest optimism score of all, at just 1.80/5, reflecting ongoing challenges and uncertainties in the sector.

Domestic concerns

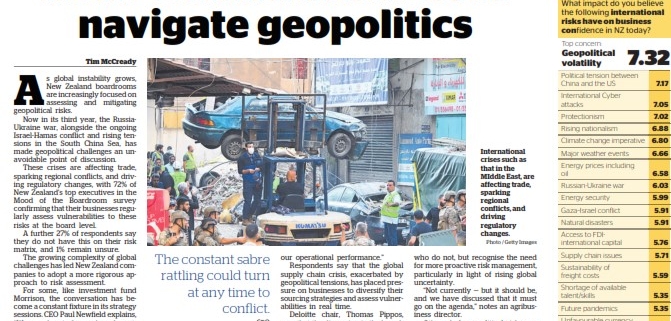

Executives were asked to assess their concerns on various domestic issues, and despite the improved optimism in the economy, several high-scoring challenges persist.

Energy-related concerns have surged to the forefront of business anxieties this year.

Energy price increases topped the list of domestic concerns, scoring 7.55/10 on a scale where 1=”no concern” and 10=”extremely concerned”, with executives troubled by the rapid escalation and volatility in energy costs. Closely following, with a score of 7.45/10, is the reliability of energy supply. The interconnectedness of these concerns underscores the pressure businesses face from the energy market.

Inflation and cost of living pressures remain significant, scoring 7.48/10.

Blair Turnbull, CEO of Tower, highlights the ongoing challenges: “Cost of living is an immediate concern and something we’re very focused on. We’re seeing continued strong retention as New Zealanders value their insurance and are prioritising premium payments. We’re helping customers with ways to lower premiums and improving business efficiencies to remain competitive. As inflation has begun to settle, we’ve already adjusted our pricing, and we expect to see pricing increases ease further toward the end of the year.”

Interest rate levels are also a pressing issue, scoring 7.14/10 and the Reserve Bank’s management of the Official Cash Rate (6.76/10).

An agribusiness chair noted, “Due to New Zealand debt levels, the economy is shrinking faster than expected and the Reserve Bank have been too slow to cut interest rates. The next year will see massive drops to stimulate the economy.”

Other notable domestic concerns include cyber threats (7.01/10), rising insurance costs (6.97/10); and climate change policies (6.72/10).

Paul Newfield, CEO of Morrison, offered a broader perspective on the factors holding New Zealand back: “In global terms, we benefit from a relatively open economy, low levels of corruption, and high levels of transparency.

“What’s really holding us back is lack of capital, short-term thinking, and not enough global ambition. That’s more on business leaders to solve than it is on politicians.”

Long-term thinking and collaboration needed

“Lack of long-term thinking and joint public-private sector engagement on options is impacting business confidence,” notes KiwiRail chief executive Peter Reidy.

The lack of societal cohesion and its impact on economic stability was also raised as another point of concern.

Bagrie Economics managing director and chief economist Cameron Bagrie warns of the “division across society,” describing it as “economically and socially corrosive”.

AUT Chancellor Rob Campbell adds that the “instability and uncertainty of social, economic, and environmental conditions dominate.”

Concerns directly related to Government and its policies have receded compared to last year.

The level and quality of Government spending, for instance, scored 6.60/10 this year, down from 8.17/10 in 2023. “The volume of public sector spend has reduced significantly as expected following the change in Government and as countries seek to balance accounts following the additional spend during Covid,” says Beca executive chair David Carter.

Foodstuffs’ Quin says he sees some promising signs with a new Government now in office:

“There’s a renewed focus on investing in critical infrastructure, a stronger emphasis on law and order (which our store teams know firsthand is much needed), and a more thoughtful approach to how public money is spent.

“One positive lesson from Covid was that New Zealanders would align and act as a team.

“Business needs to do this, speak up, and focus to play its part in the solution.”

Skills shortage easing, but challenges remain for NZ businesses

Finding suitably skilled staff remains a significant challenge, though the situation is showing signs of improvement. The Mood of the Boardroom survey asked executives how easy it has been to recruit a suitably skilled and qualified staff member.

On a scale of 1-5 where 1= “very hard” and 5= “very easy”, the average score was 3.37/5. Despite the relatively high score, responses varied depending on the sector and the specific roles being filled.

For some sectors, the recruitment landscape has seen marked improvements, largely because of recent redundancies in the market.

The head of an engineering consultancy observes “There are great people in the market because of the rightsizing that is happening across the economy. The challenge is that with the downturn in the infrastructure market, we are seeing more people looking to head overseas for the larger projects.”

Carrie Hurihanganui, CEO of Auckland Airport, agrees, noting that conditions have “improved considerably from last year, but still challenging to get some of the highly skilled roles we are looking for.”

In hospitality, Craig Bonnor from Cordis Auckland says “Things have improved from the same time last year”. Freightways director Mark Cairns echoes this sentiment: “Much better than last year.”

Paul Newfield, CEO of Morrison, says though New Zealand continues to produce great talent and attract investment, the small investment management ecosystem presents challenges. “We often need to look to Australia to recruit highly specialised roles. Ultimately that’s a consequence of New Zealand’s low retirement savings rates and small capital pools,” he explains.

Dame Therese Walsh, chair of Air New Zealand and ASB, highlights the ongoing difficulty in sourcing specific skill sets: “Certain cohorts of skilled labour such as engineers and data scientists still hard to come by. In other areas, key issues for attracting talent are culture and wages.”

The CEO of a major research firm says that it is hard to attract both technical/specialist staff as well as those for corporate roles. “We are getting a lot of applications, but usually lower quality than desirable. We are struggling to reconcile candidate pay and benefit expectations versus our assessment of their skills and qualifications.”

KiwiRail CEO Peter Reidy highlights a persistent issue in his industry, stating, “Technical rail expertise is a global issue, with New Zealand’s attractiveness reducing for offshore recruitment compared to Australia.”

Chris Quin, CEO of Foodstuffs North Island, believes the situation is improving, but underscores the need for New Zealand to remain an attractive destination for global talent.

“Access to skills and talent has gotten better. While New Zealand is increasingly open to talent we need to keep working on being an attractive option for people who have the skills we need and want to make New Zealand a home for them and their families. If we’re going to have more open immigration policies, we need to respect, value and welcome the people who choose to live and work here.”