Capital Markets: Venturing closer to maturity (NZ Herald)

Tim McCready

Richard Dellabarca, chief executive of the NZ Venture Investment Fund, has completed a strategic review of the industry and provided growth options to Government, reports Tim McCready

Last year, then Economic Development Minister Steven Joyce announced a review of New Zealand Venture Investment Fund’s structure, reiterating the Government’s ambition for the fund to become self-sustaining.

Soon after the announcement, Richard Dellabarca was appointed chief executive of NZVIF in mid-2016 — a move that indicated the industry was maturing.

Dellabarca, an investment banker, had spent 14 years offshore in a variety of leadership roles in venture-backed companies, capital markets, financial services and technology-related opportunities.

He brings a private sector investment perspective, but given his experience as an entrepreneur he understands what is required to build globally scalable companies.

“Really good Venture Capital funds (VCs) are looking to build businesses. Investment is an important skill to have, but their greatest skill is in building companies,” he says.

“It helps to have gone through the journey of building a global company, or a company with global aspirations, in order to understand what is needed.”

When Dellabarca joined NZVIF, he was given a blank piece of paper and the mandate to go away and undertake an independent strategic review. He has spent the last year speaking with stakeholders — around 140 organisations and 230 individuals.

Dellabarca says he is encouraged with the significant amount of investable opportunities in New Zealand, noting that founders and teams tend to be aspirational and motivated, and companies aim to be global from day one.

The review noted a growing amount of angel investment — $69 million in the last year, and more than $400 million since figures have been tracked — in addition to the significant investment into universities and Crown Research Institutes.

There is money available in New Zealand to fund proof-of-concept in early stage companies.

But a shortage of funds was identified for opportunities requiring $5-20 million in early stage growth capital.

In addition, Dellabarca noted that in the Silicon Valley or the UK, “you generally see funds syndicating with two or three investors when raising Series A & B investment.

“Yet over here, we have only Movac and Global from Day One (GD1) investing locally in growth capital, severely limiting the opportunity to syndicate investments or fully fund early stage growth companies through to maturity — and ultimately a successful realisation of the investment.”

Although eight Venture Capital funds were originally established in New Zealand, the average fund size was only NZ$45 million compared with a global average of approximately US$300 million.

Dellabarca explains there is a good reason for global fund sizes given the amount of money a company generally requires through to an investment realisation.

“They will tend to invest in, say, 15-18 companies at $5-10 million each, and then keep money aside for further follow-on investment in companies that are succeeding.

“This allows for better funds management practice, managing downside while optimising on upside opportunities,” he says.

“These historic sub-scale New Zealand funds tended to invest in a range of companies, but then either didn’t have capacity to fund them through to success and, therefore under-capitalised them, or had later stage investors dilute them down when they couldn’t follow on with the investment.

“The consequence was that many of these funds didn’t generate appropriate returns for their investors,” Dellabarca says.

While offshore corporates and financial institutions have had an interest in allocating money into New Zealand technology innovation, they have not been able to find a platform to put the money in.

As many of these institutions manage multibillion-dollar funds, the smallest investment they are willing to make is $50-$100 million.

“With an average fund size of $45 million, their mandate will often preclude them from being more than 10-20 per cent of a fund,” says Dellabarca.

“By definition you need a $300 million to $400 million fund to take these cheques.

“We just haven’t set up a fund of scale to allow foreign investors to come in and access innovation.”

NZVIF have presented a number of options to Economic Development Minister Simon Bridges that aim to make the fund self-sustainable.

Although Dellabarca is unable to divulge the details on those options, he says the fund-of-funds model with its hefty fees on fees structure is no longer viable.

The results of the strategic review provide a clue that early stage expansion capital for growth companies is New Zealand’s choke point, and is a gap NZVIF would like to address if a model that works can be established.

“There is an unmet need. You could argue about the specific number but the current deal flow suggests an annual demand of $200-$300 million,” says Dellabarca.

“If you assume our current VCs invest over five years, holding back 30 per cent for follow-on investment (the traditional venture capital investing model), then you have approximately $20-$25 million invested per year, versus a demand of up to $300 million per year.

“But whatever the number is, it is substantially larger than available capital. The aspirational goal is to have that need met in some way or another.”

Considering the future, Dellabarca says that he would like to see more money in the angel space. NZVIF is currently the second largest angel investor in New Zealand, and he hopes that in time it won’t be needed.

He has the same goal for the venture capital space.

“Hopefully in 15 years we won’t need a NZVIF in any guise, and instead there will be several self-sustaining funds of scale,” he says.

“We don’t have government intervention in private equity.

“You would hope that ultimately the same will happen in the venture capital space.”

Power of NZVIF?

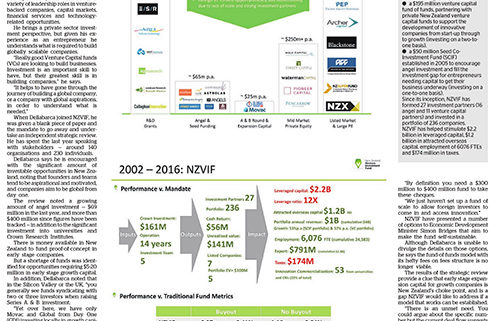

The NZ Venture Investment Fund (NZVIF) was established by the Labour Government in 2002 to build a vibrant early stage investment market in New Zealand by investing alongside private venture capital funds into high-growth companies.

NZVIF currently has $245 million of funds under management which it invests through two vehicles:

- a $195 million venture capital fund of funds, partnering with private New Zealand venture capital funds to support the development of innovative companies from start-up through to growth (investing on a two-to-one basis).

- a $50 million Seed Co-Investment Fund (SCIF) established in 2005 to encourage angel investment and fill the investment gap for entrepreneurs needing capital to get their business underway (investing on a one-to-one basis).

Since its inception, NZVIF has formed 27 investment partners (16 angel and 11 venture capital partners) and invested in a portfolio of 236 companies.

NZVIF has helped stimulate $2.2 billion in leveraged capital, $1.2 billion in attracted overseas capital, employment of 6076 FTEs and $174 million in taxes.

Leave a Reply

Want to join the discussion?Feel free to contribute!