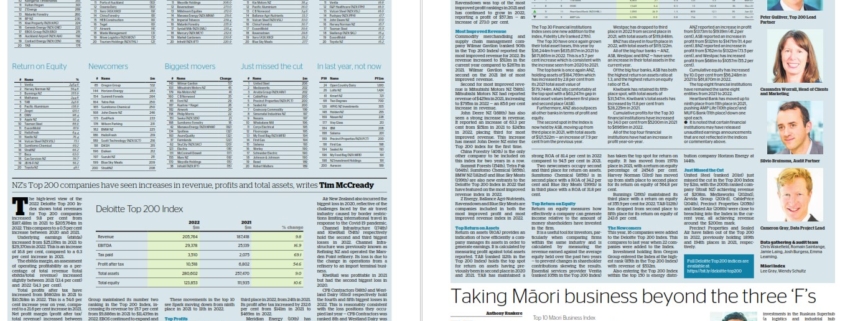

Deloitte Top 200: Top business leaders crowned with awards back in black tie

Vulcan Steel has taken out the top award as Company of the Year in the 2022 Deloitte Top 200 Awards, recognised for its recent exceptional performance for both the company and shareholders.

Winners for the Deloitte Top 200 awards were unveiled at Auckland’s Shed 10 last night, showcasing the very best of New Zealand business and business leaders. Now in its 33rd year, the highly anticipated black-tie dinner event was back at full scale for the first time since the pandemic.

An earlier celebration in 2020 was limited to 100 guests due to Covid-19 pandemic restrictions. In February this year, a celebration of last year’s winners took place online.

This year, the awards recognise outstanding results despite the ongoing challenges resulting from supply-chain constraints, skills shortages, inflation, and the ongoing pressures resulting from the pandemic. Companies and individuals have been recognised for showing commercial strength, leadership and agility during challenging times.

Vulcan Steel thrived as a privately owned steel distribution company for more than 20 years. Since listing in 2021 it has delivered total shareholder returns of 32 per cent. Operating profit has increased by an exceptional 82 per cent and net profit by 119 per cent.

The panel of high-profile judges — convened by NZME head of business content Fran O’Sullivan — said Vulcan Steel stood out in its category due to its recent performance.

“They are a long-term New Zealand success story, led by an outstanding and committed leadership team,” say the judges. “This year Vulcan Steel also successfully acquired Ullrich Aluminium, which has added to their range and helped to underpin further growth. Although the steel and metals markets have been buoyant, helping to lift pricing, Vulcan’s performance has been exceptional.”

A previous winner of the Top 200 Chief Financial Officer of the Year award, Spark’s Jolie Hodson has this year taken out the award for Chief Executive Officer of the Year.

In her time at Spark, Hodson has played a pivotal part in transforming the company from a legacy telco to a growing digital service company. Becoming CEO in 2019, she is highly regarded in the market and has strongly positioned Spark within a highly disruptive and competitive environment, particularly at a time when core landline revenues are declining.

“Spark has continued to be a market leader on the NZX with shareholder returns of 12 per cent over the past year ending in September, and 17 per cent per year over the last 10 years,” say the judges.

“Jolie has a strong view on the role that digitisation can play in decarbonisation and helping New Zealand to meet its climate goals, becoming the convenor of the CEO steering group for the Climate Leader’s Coalition in June 2022.”

The Visionary Leader award is the only one given without finalists. This year, the award went to powerhouse siblings in the wine industry, Jim and Rosemari Delegat.

The judges recognise the Delegats for their vision of New Zealand as an exporter of super-premium wine to the world’s most discerning markets.

The result is a company that today sells more than 3.3 million cases of wine, mainly overseas. Delegats is now a $1 billion public company which, since listing in 2006, has delivered an annualised total shareholder return of 16.5 per cent a year — a remarkable success story that is reflective of the vision and leadership Jim and Rose have brought to the company bearing their family name.

Chairperson of the Year was awarded to Mark Verbiest. Verbiest, who chairs Meridian Energy and Summerset Group Holdings, is a highly esteemed chairperson who is known to operate with a respected and trusted governance style, taking on roles with organisations that involve both a challenge and will also make a meaningful difference to the country.

The judges say that at Summerset and Meridian Energy Verbiest is tackling some of New Zealand’s greatest issues. He is committed to providing quality care for our ageing population and is highly supportive of Meridian’s clean energy aspirations, which will significantly contribute to New Zealand’s goal of achieving net zero greenhouse gas emissions by 2050.

Infratil’s Phillippa Harford has been awarded Chief Financial Officer of the Year.

The judges say Harford has been recognised by management, the board and the market as a leading CFO and a key executive behind Infratil’s success and superior return to shareholders.

“She has made key contributions to the company’s acquisitions and divestments such as Vodafone, Tilt Renewables, and long-road energy, all of which have helped to drive value for Infratil,” they say. “Phillippa has also been an effective team leader for the finance function, and has been central to developing judgments and strategies on complex international tax and accounting issues and financing structures linked to Infratil’s international investment footprint.”

Fonterra took out the Most Improved Performance award this year. The dairy co-operative, owned by 10,000 farmers, paid close to $14 billion to its dairy farmer suppliers this year. The judges note positive improvements across the business driven by a refreshed, local management team.

“Fonterra sometimes faces vocal opposition to their industry,” the judges say. “But they have made moves to become more sustainable and have recently introduced a bovine emissions reduction plan along with trialling seaweed as a supplemental feed for dairy cows, and are working with Government on reducing permanent agricultural emissions.”

Scott Technology has been recognised with the Best Growth Strategy award. The judges say the automation and robotics company has continued to carve its path globally, now generating over $220 million in revenue, compared with $133m in 2017. “The world has now caught up with the company’s forward-thinking and innovative approach,” they say. “Scott Technology’s time has come as more businesses are investing in technology and automation. It is great to have Scott Technology waving the New Zealand flag in such a future-focused industry.”

Air New Zealand’s tribe lead – loyalty, Kate O’Brien, has been awarded the title of Young Executive of the Year. She has forged a remarkable path through different sections of the Air New Zealand business. Judges say she has the ability and insight to continue growing her career and leadership influence.

“Kate is impressed with a strong worldview and a passion for business improvement,” they say. “As a leader, Kate is sensitive to the impact she has on her team — she understands the importance of staying calm and positive to sustain conditions that are conducive to others’ success.”

Spark has taken out the Diversity and Inclusion Leadership award for its Cloak of Growth, Beyond Binary, Mahi Tahi Wellbeing and Blue Heart concepts that drive all forms of diversity and inclusion across the company.

“Initially led by management, the cultural framework is now very much led by its people and has become part of the company’s DNA,” the judges say, noting that the programme has achieved impressive results. “Spark has reached a world-leading net promoter score of 84 for ‘bringing your full self to work’, they’ve significantly reduced their overall gender pay gap, achieved job-to-job pay equity, and their board and wider leadership group is now made up of 47 per cent women.”

The judges believe Spark’s broad and horizontally embedded approach to diversity and inclusion is market-leading — setting a fantastic example for other businesses in Aotearoa.

For the second year in a row, KMD Brands won the Sustainable Business Leadership award, which recognises businesses working toward the creation of long-term environmental, social and economic value.

The judges commend KMD Brands for its well-established and evolving sustainability policies and practices that are central to its operations and business model. With Kathmandu a certified B-Corp and Oboz and Rip Curl also making strides towards BCorp certification, KMD Brands’ approach to sustainability is strong, holistic, and genuine.

The Deloitte Top 200 awards include a special Judges’ Award. This award enables the Top 200 panel to highlight performance the judges feel is of importance to the business community.

They chose renowned tax specialist and Māori leader Sir Rob McLeod as the recipient this year. He has held notable senior leadership roles including CEO of Ernst & Young Australasia, chair of the 2001 government tax review and eight years as chair of the New Zealand Business Round Table. Chair of Sanford, Quayside Holdings and Ngati Porou Holding Company, and director of Port of Tauranga, Sir Rob was awarded a knighthood for his services to business and Māori in 2019.

“Throughout his glittering career, Sir Rob has championed gender equality and indigenous engagement,” the judges say.

“A retired member of the Business Council of Australia, including membership of the Indigenous Engagement Taskforce, Sir Rob also served on the Hui Taumata Taskforce in 2006 to increase Māori participation, leadership and governance in the workforce. Sir Rob’s immense contributions to date, alongside those still to come, will continue to leave a legacy well into the future for New Zealand and Australian business and our wider communities.”

In this local body election, what if we could do a little more than a tick and a prayer?

In this local body election, what if we could do a little more than a tick and a prayer?